Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

There is very little that Richemont can do about a crackdown on graft and gifting in China, there is even less that the company can do about terrorism and people delaying travel to Europe. On those said trips, often people buy the expensive products that they produce. The company will continue to produce their quality products, which are timeless in themselves. In fact, as we often say around these parts, the longer they own the timeless and obviously quality brands, the more valuable the name and brand becomes. I look at LV bags and can't see the attraction, mind you, what the hell do I know about bags! The brands are what they are, old, quality and pretty much timeless.

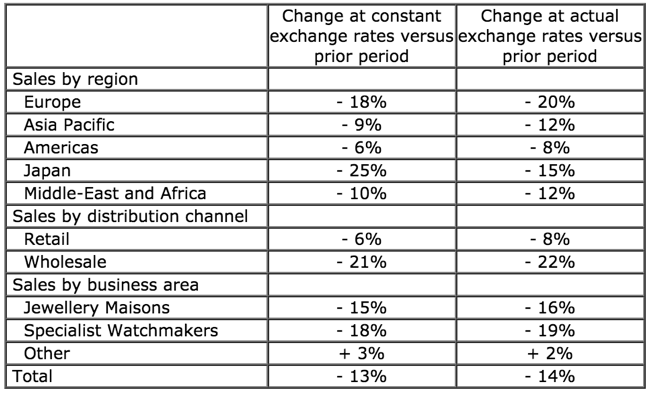

The luxury goods business has their AGM today and have released a five months trading update as is customary - Richemont Annual General Meeting 2016. And I can say that it looks pretty ugly, far worse than most would have expected. As they say: "sales were down, particularly in France, due to a significantly lower level of tourist activity." The only positives, and we have seen this for a while now, is that mainland China is growing. As the company points out however: "growth in mainland China and Korea was more than offset by the continuing weakness of the Hong Kong and Macau markets." Here is the sad looking comparison table:

The share price has reflected some of these weaknesses and will continue to trade softer is my sense, the outlook points to a much weaker six months: "We consider that the difficult trading conditions are likely to continue during September. Operating profit for the six months ending 30 September 2016 is therefore expected to be approximately 45% below the prior year's level, reflecting the effect of one-off restructuring charges of approximately EUR65 million, and the additional effect of the product buy-backs."

The medium term outlook suggests that not much is going to change. The group reckons that not much is going to change in the short term. They do continue to state the obvious "we remain convinced of the long-term prospects for luxury goods globally, and in particular for watches and jewellery. Richemont is well positioned, with a strong balance sheet and a portfolio of long-established Maisons."

The share price in Rand terms, as horrible as it has been, has been protected somewhat from a currency weakening relative to the Swiss Franc. Over the last year in Swiss Francs that price is down nearly 16 percent, more I am guessing after this worse than anticipated sales update. The stock in Swiss Franc terms is down 36 percent from the highs reached in late May 2014, it has been more than a little tough out there. The best thing to do as multi year holders of quality businesses is to hold here, even to add on weakness. The corner may be a way off, people may well spend heavily on experiences (more travel), they will continue to want timeless and valuable jewellery. To that end, Richemont is not just in the premier league, they are arguably the owner of some of the best brands known to consumers. Hold the line whilst it is tough out there!