Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

OK, it is time that we review those Steinhoff results. Firstly, it is important to recognise the massive transformation of this business over the last half a decade, from Conforama in Europe to Pepkor across the globe, the company has been ambitious and has definitely pushed the envelope. Should that worry you? I guess that if one of the richest South Africans has basically thrown in his biggest asset in here and is the biggest shareholder, then he has done his due diligence. I am of course talking about Christo Wiese, who in his mid seventies has decades of retail experience. He has thrown in his lot with Steinhoff, Brait and of course various others that include Shoprite (of course), Invicta and Pallinghurst. To mention a few, there are more, that Wiese fellow is a warrior.

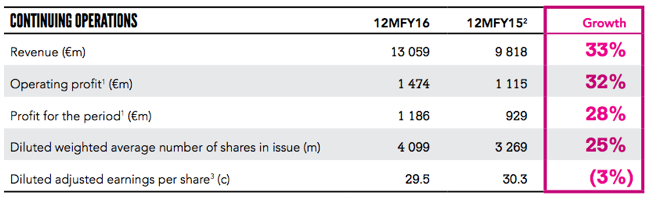

Straight into the numbers, from the booklet:

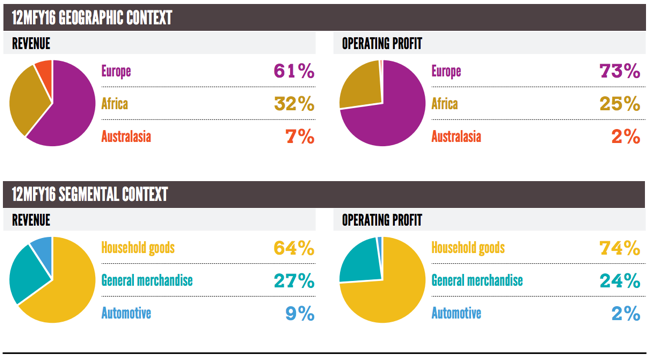

See that the shares in issue increased substantially, diluting earnings per sharer, which actually went backwards. The purchase of Pepkor is the share issuance (and dilution for you) and then the 17 percent devaluation in the South African Rand. Here is the geographical breakdown by territory and segment. It is fair to say that this is more a European business that sells household goods. And is most profitable in that geography and that business. Automotive, not good, 91 dealerships and 48 rental outlets, that is all.

Conforama sells mostly furniture and white goods (72 percent) in France (67 percent of sales). South Africa has the biggest store footprint in household goods, there are 945 (there have been aggressive closures this last year, 123 in total in Mzansi) Bradlows, Rochester, Russells, Sleepmasters, Incredible Connection and HiFi Corp. Conforama in France has 204 outlets with 738 thousand square metres of space. Phew, there are a lot of Pep stores in Southern Africa, nearly 2000. Yowsers.

The group never stands still. Recently there has been the acquisition of Poundland in the United Kingdom, Mattress Firm in the US, the intention is there to close that deal and make the company the largest mattress distributor in the world, and of course closer to home, Tekkie Town. Why so many deals? I suspect that they want to build something huge, borrow heavily whilst rates are low and acquire cheap assets in a time when prices are suppressed historically. We continue to own this business for the long run, management are hard running, the giant share holding by Wiese is a huge plus in my books. Checks and balances on the hard running management and the ability to tap a wealth of experience at the same time. Expect them to continue to buy and accumulate over time, as should you on weakness.