Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received another set of solid full year results from our favoured retail stock, Woolworths. Lets delve into the numbers straight away and then we can discuss the different segments.

Group sales increased by 16.4% to R72bn. Basic headline earnings increased 44% but if you include the extra shares from the rights issue headline earnings per share increased 8.9% to R4.56. Trading at R87 a share the stock affords a respectable multiple of 19 and a dividend yield of 3.6% before tax (313c per share to be paid this year).

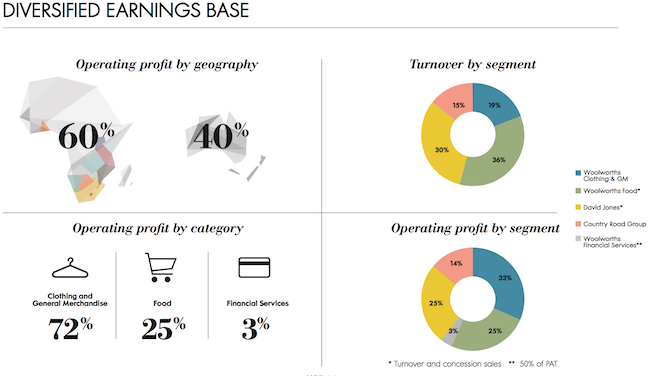

Sometimes a picture says a thousand words, this infographic from the presentation says more.

Often referred to as a grocer, Woolworths only makes one quarter of their profits from selling food. That segment grew 11.9% due to a 5.7% growth in volume and a 6.7% growth in price. The Woolies client is still happy to pay up for quality. Profits in this segment grew 15.6%.

As you can see, the clothing division is divided into 3 segments. Clothing and General Merchandise, David Jones and Country Road. Funnily enough a late winter in both Australia and South Africa took much of the headlines. CEO Ian Moir even said on the radio that they had employed meteorologists to try and predict the seasons. Thats what fast clothing retail has become. Gone are the days when one leather jacket would last you 15 winters. These days you have to stick to the trends. A cold winters breeze on your skin sends you straight to the Woolies to buy the latest jackets. Despite this, Clothing sales grew 9.6%, David Jones grew 8.4% and Country Road grew 5.5%.

When they bought David Jones the business needed a fresh turn around and that is exactly what we are seeing. Woolies management have a great knack for creating a world class retail experience which draws customers in. They have sold one of the old legacy properties for R3.8bn and will be using R2.1bn to build a brand spanking new, 7 story department and food store in Sydney. I am sure it is going to be fantastic. Because of its proximity to Asia, Australia is fast becoming a big luxury goods destination. I am very confident in that economy's ability to diversify and thrive even with lower commodity prices.

And that is why we own the company. We back the fabulous management to continue to bring in clients and maintain quality products. Retail in general will remain competitive, tough and cyclical. These guys have the ability and quality to ride these waves and continue to produce stellar results. I think at a historic PE of 19 and forward closer to 16.5 the stock is presenting a great buying opportunity. Plus you are getting paid over 3% yield as a bonus.