Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we had the maiden results from Bidcorp since their listing on the JSE. What makes looking at these results a bit tricky is that there are no comparative figures to work with, management have provided pro forma numbers based on the assumption that the current entity existed in its current format a year ago.

Here is a quick look at all the regions that Bidcorp operates in, as you can see they are a global company with North America the only major region missing.

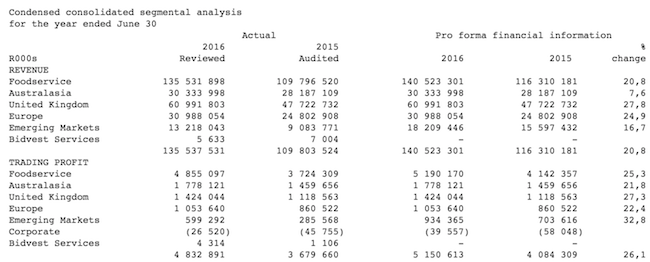

Moving onto how those regions contribute to Revenue and profits:

Their main operating area is Australasia, which contributes around 22% of the revenues but 35% of their profits. Next on the list is their UK business which is the bulk of revenues at 43% but 'only' 27% of the profits. It was interesting that they said one of their growth constraints in the UK was a lack of labour. Does that mean less and less people are willing to drive trucks and work in factories? Well done Brexit. On to the Emerging Markets division, China is one of the countries they operate in where they are still growing a foothold. The division is still relatively small but has huge upside potential given the big shift in China towards more consumption.

Going forward the group is looking to focus on the higher margin, more specialised parts of their business, basically they want to get out of the very vanilla logistics business. Given that trading margins for the group is 3.7%, the low margin business must be really low margin. In these sort of highly competitive spaces, being able to keep costs under control is important, Bidvest / Bidcorp have shown in the past that they are skilled cost cutters.

Onto the numbers, their HEPS for the full year 2016 was R10.80 which puts them onto a P/E of 25. This is not cheap but not excessive especially if you consider that HEPS growth was 32% over the last year on a pro forma basis. Another reason that the stock trades at a premium is due to its defensive nature, until we can replace meals with a pill food supply it is going to be important. Also lets not forget about their global footprint, which adds good diversification to your personal portfolio.