Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Ali Baba might have fought off the 40 thieves, the founder and CEO of the Alibaba group certainly had bigger hurdles to overcome. The story goes that Jack Ma invited 24 friends to his house and presented his ideas for the business to them, they listened for two hours. Only 1 out of the 24 folks there thought that the idea of the marketplace that Ma put to them would be a commercial success. Ma is known for his pithy quotes, saying stuff like "if you are not rich by 35, then you only have yourself to blame". In fact he was harsher than that, he suggested that you were poor because you have no ambition. Which is a little harsh. Like most entrepreneurial types, he is more than a little crazy and a whole lot quirky. He is in many ways not too different to Musk, to Bezos, those types of people who relentlessly put their ideas into action.

Enough about the man, people and their ideas are as good as customer adoption. I remember first coming across the business around ten years ago, it seemed like a wonderful idea. A business to business portal, putting you in touch with a business somewhere else around the world and being able to get the goods directly to your front door, no matter where you are and where the goods are. This business is as dominant in China as Amazon is in the US, they are pretty much to online retail as Google are to search, one and the same in consumers minds. A quick squiz at the Tmall website sees that you can pretty much buy anything you want. I am still surprised in 2016 that shopping isn't dominated by online. We will get there, young people just need to become richer, that will happen too. I can imagine that the malls of the future will become more entertainment destinations. Last week we saw Macy's closing 100 stores, all unprofitable no doubt. JC Penney and Sears have also been closing stores.

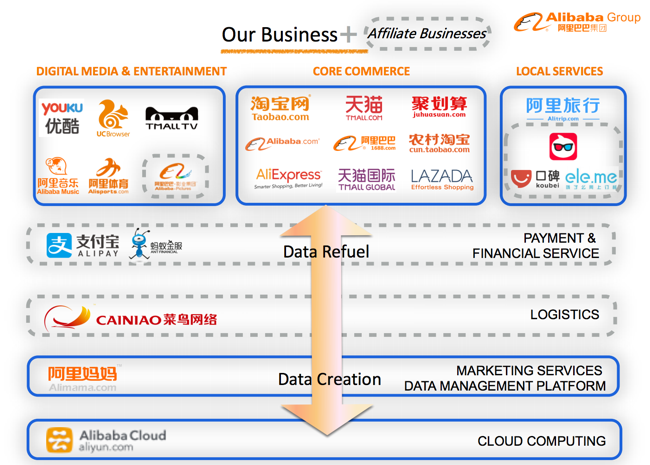

OK, to the results from the other night, we all have a fair idea of the history of the business and the founder, and we all understand that future retail will continue to take place online. It has to. Here is the press releases of the results themselves - Alibaba Group Announces June Quarter 2016 Results. I am amazed that revenues for the quarter continue to clock such huge increases, most especially now that the group revenues for the quarter are 4.838 billion Dollars. Adjusted EBITDA increased by 43 percent to just over 2 billion Dollars. On a per share basis EPS clocked 74 US cents. The group continued to make progress across all brands. Here is the structure, looks a little Naspers, not so?

Mr. Market really liked the numbers, the stock soared over 7 percent to close just above 98 Dollars, a 52 week high. And seeing as all things China have been under pressure, the stock is up really smartly from the 57 Dollar low reached last October, and 60 Dollars in February this year. The company has an amazing network now, 427 million monthly mobile users in China. And remarkably, off an ever increasing base, the revenue growth is not the fastest since the company IPO'ed in September 2014. Whilst you cannot own everything, and one owns loads of Naspers in the local environment, if you need direct access to a Chinese consumer that is in the next phase of growth, consumer focused, look no further than this business. New York listed and US audited, I reckon trust will eventually arrive for Chinese companies, the stock trades on 23 times earnings. The chattering classes may think that you can fudge the national numbers, you can't fudge these numbers.