Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

We have been promising you some of the results that have been knocking around. There have been some stocks that we promise you a write up on. Under Armour has been one of those. Whilst the stock is not a mainstream holding, it is a company that we do own for enough clients to be more than an interesting side holding. It is true that you cannot own everything, best we all get used to that idea now. This company is in the space of where athleisure overlaps mainstream fashion, and a more health conscious world wakes up to the idea of looking after number 1. That number 1 of course is yourself, there is no plan b for your health.

It is interesting that the best investor known to our generation, Warren Buffett, is both very aware of this fact, saying that your health is your number one and best investment, whilst acknowledging that he consumes a vast number of sodas and peanut brittle. He once told Forbes in an interview that he eats like a six year old. Depending of course which family you come from, it is either junk food or peas and carrots. I guess he means a six year old with no boundaries.

OK, first to a company that is becoming a serious contender to the global forces in this space. Innovative and comfort, from the professional to the amateur, to the pinnacle being the Olympics. Under Armour punches comfortably above their weight in that regard, whilst they haven't been a frontline sponsor of the Olympics (you need to shell out hundreds of millions of Dollars for that), the changing rules from the organising committee means that companies sponsoring the athletes can definitely advertise.

The US woman gymnastics team, and specifically Simone Bile (#winning big) and the US swimming team and specifically Michael "the killer stare" Phelps (#winning bigger with 22 golds now) have been high profile scores for their brand. And Andy Murray, he is still in with a chance, even if Djoko and Serena are gone. Murray has the easiest quarter-final (seemingly) today, a little later. There are of course other high profile athletes like Steph Curry (he is an amazeballs basketball player) and Jordan Spieth (at 23, he has won two majors already). There is ballet dancer extraordinaire Misty Copland and that guy who married Giselle Bundchen, Tom Brady (4 time Super Bowl champion).

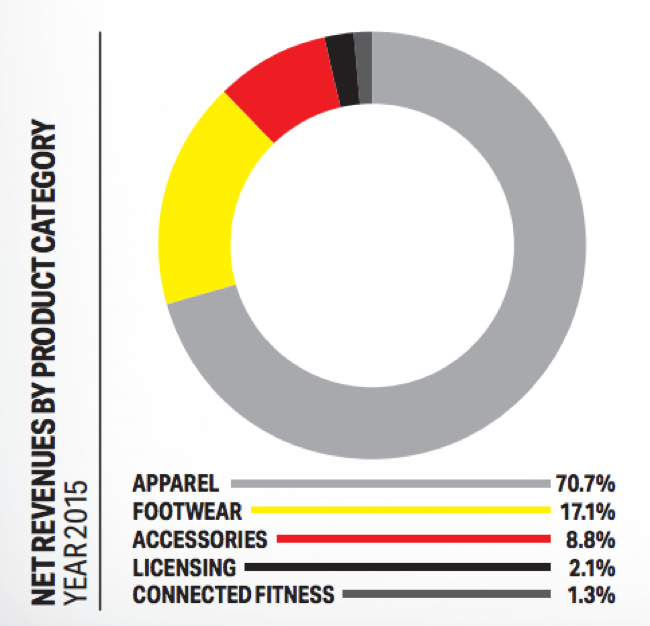

You don't however make a brand like this in a single or even string of Olympics. The company now has revenues expected for the full year, as per the outlook, of just shy of 5 billion Dollars, which represents around 24 percent growth from the prior financial year. For comparisons sake, Nike has annual revenues expected of around 34 billion Dollars this year. Adidas has annual revenues of nearly 17 billion Euros (nearly 19 billion Dollars), Puma of 3.4 billion Euros (3.8 billion Dollars), in that region. So, if you add up all of the competitors of Nike, you are not quite at the same level yet. Are you surprised that Under Armour outstrips Puma? The company sell far more apparel than shoes. The rise of athletic wear has been phenomenal. See, from their last annual report:

The company is an apparel company that has recently been making shoes. The chief of this business is not short of confidence. Kevin Plank speaks with a lot of confidence, a recent revamp of a prime New York location (the former FAO Schwarz space on Fifth Avenue at the base of the GM Building) led him to say they are going to "build the most breathtaking and exciting consumer experience ever conceived at retail." Plans are big, the base has been built over the 20 year history and the 10 year listing.

The stock has done well. And that is part of the issue with wanting to own them immediately, forward the stock trades on a 46 multiple. Whilst revenues and profits have grown sharply, there is a large spend rollout to "get bigger", which may take some shine off earnings. And in that may well lie an opportunity. If you do own it, definitely hold it. If you don't and want to, let us watch this one closely, there will possibly be a few opportunities to buy them in the coming years. Great business, amazing brand, super growth prospects, the price looks rich currently. If you are a multi year holder, the prospects are good enough for you to accumulate at the fringes immediately.