Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

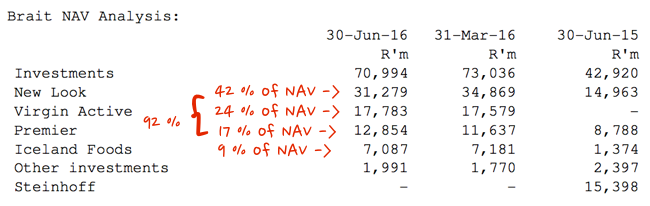

Brait, the investment holding company, released their Net Asset Value update for the first quarter of the financial year. The share price has taken a terrible beating lately as the impact of Brexit takes it's toll. NAV decreased by just over three percent for the quarter, largely due to the Rand. The release fleshes it out: "The impact of the UK referendum vote to leave the European Union resulted in the Pound weakening 7.5% against the Rand from ZAR21.21 at 31 March 2016 to ZAR19.62 at 30 June 2016."

So where is the Rand from there, the end of June? It is another 12.12 percent stronger since then to the Pound Sterling, compounding the matter even more. There is little that you can do about the currency. There is nothing that you can do about the average British voter, even if 1.2 million of them suffer from voters remorse. I read that, there are genuinely voters who thought they were doing x (they were doing an x) by voting for that. Whereas they hadn't really been doing that. The stock is down at the get go this morning, just over 6 percent as the collective mull the implications of the stronger currency.

First, let us look at what they own, and what they value it at. As Michael points out, if you are using a lot of gearing, then a Enterprise Value to EBITDA value is better to use. So cash generation to pay down debt is important. For better or worse, Brait owns mostly retailers, food and clothing. As you can see, New Look is the one investment that has been "not good".

Negative headlines and an outlook that looks a little less rosy means that consumers are likely to spend less. Paul tweeted a link to an article (Internet Of Clothes: Nanny Wardrobe Reminds You To Wear Items, Or It Gives Them Away) that says: "The academics behind it lament that as a society we own four times as many clothes as we did 20 years ago, but regularly only wear about 20 percent of them" What? So it turns out that we buy more clothes than we need and we wear them less often. The likes of H&M, Marks & Spencer, TopShop (the Arcadia Group), Debenhams, Primark (more so) and Next are all competitors, it is not an easy space to operate in. Yet, they should all benefit from this trend.

What to do now? The stock took some heat, ending the day down around 5 percent. Trading below the reported NAV, my sense is that calculating the worst of the recent performance of their main asset and adjusting for the currency, the market has got it about right. I am very sure that the Brait management team are feeling very bruised right now. I wrote to a concerned client yesterday: "The irony was that investors were scrambling to own stocks exactly like this. The Pound has almost everything to do with, equally Brexit sentiment. Whilst New Look will suffer locally (in the UK), the offshore business (i.e. China) will grow quicker. The other businesses are all fine."

Yes, they are weak at the moment, the share price, based on a weak home (UK) looking market. A good space, and they no doubt will sweat their assets even harder. Expect some of the best operators and allocators of capital in the ZA market, and now on a global scale, to drive the wagon harder. We accumulate the stock at these lower levels.