Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Amgen reported numbers last week - Second Quarter 2016 Financial Results. It is not as tough to report on a company that has a very focused consumer front facing business, in many cases we use loads of consumer products like Apple (your phone or computer), Google search (or Android phones), Facebook (Instagram and WhatsApp), Amazon (reading your Kindle, ordering online), Nike (go for a run or to gym), JNJ and L'Oreal (shampoos and consumer products), Netflix even, perhaps even Priceline (Booking.com). Whilst you are wearing your Luxottica (sunglasses) products. Those businesses you know and use, and you are very familiar with.

Somehow, a company that makes very specific therapies that in some cases only have a target for 3 to 4 hundred thousand potential customers, that is harder to get a handle on. In fact, as the therapies are definitely for life threatening illnesses, you pretty much hope that you are not ever a consumer of their product. It may well be easier to be a user of Stryker, to get a new artificial hip or knee than to use the therapies that Amgen manufactures and distributes.

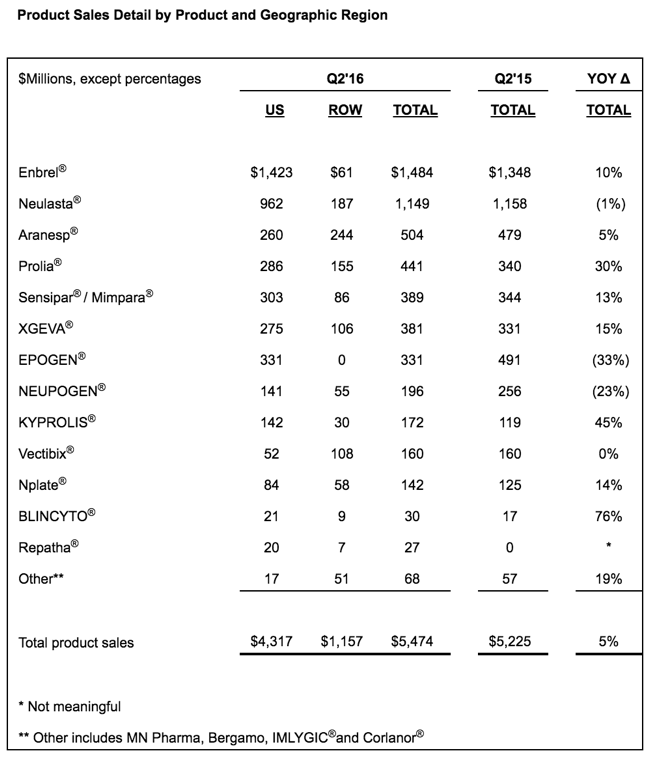

Amgen top sellers include ENBREL, which treats 5 different ailments from Rheumatoid Arthritis to Plaque psoriasis. KYPROLIS treats patients with relapsed or refractory multiple myeloma, who have been treated before. XGEVA prevents serious bone problems. PROLIA helps woman with postmenopausal osteoporosis, specifically with high risk to fractures, to specifically strengthen bones. First, a table of their big hits by sales for the quarter just passed.

Whether or not you understand what the drugs treat, or whether or not you simply try and understand the specific therapies, that does take a big amount of new reading. Mostly into fields where there could have very little expertise. It is funny how we can understand the combustion engine, yet understanding ones own body would take a lifetime. Perhaps we can see the combustion engine, all you need do is to open the bonnet (hood) and peek in. In the same way that you look at an x-ray, you look under at the engine. You really have little idea as to what is going on. Plus, I bet you didn't know that this company (Amgen) has a market capitalisation of 25 percent more than what AB InBev want to pay for SABMiller. I suppose it is easier to drink beer.

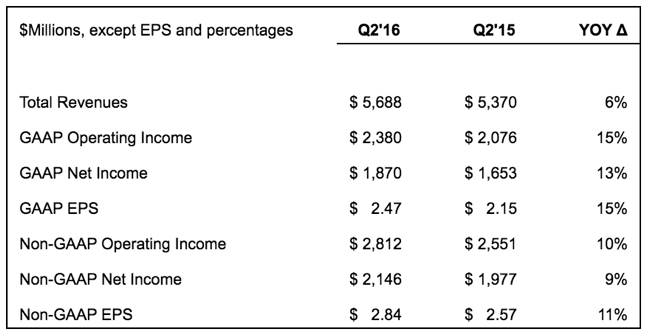

That aside, here is a breakdown of the sales and profit numbers in the associated table with the earnings release:

The company guided higher for the full year, revenues around one percent higher for the full year at the top end of the range, non-GAAP EPS range was pushed higher to a 11.10 to 11.40 Dollars a share range, that is around two percent higher than the prior top end of the range. This is obviously good news for investors. The stock has responded accordingly, over the last month the share price is up nearly 15 percent, in anticipation of good numbers. On a historical basis the stock still looks decent value at 18.2x earnings, forward (i.e. this year), that unwinds to less than 15 times. And to the end of next year, the analyst community has it at around 13 and a half times. Which, as you can see the earnings growth rate, is quite something that it is that cheap! Plus, post tax there is a two percent dividend to boot.

This is not your typical biotech business, they are a lot more mature. You may recall when we introduced the stock as a core recommendation last year in October - Amgen (2015) Q3 numbers we pointed out that they were halfway through their 4th decade of business. I will copy and paste what I wrote back then today, I strongly believe it: I would rather own a company and part with my money to own a piece of a business that is trying to cure humanity. The therapies may be wildly expensive, there may be an ethical argument about the cost of the treatments, without that, the company would not be able to recoup the money spent engaging in finding these cures.

All things being equal, the stock price should continue to gain traction as some strong pipeline therapies add to their already growing business. Finding cures and therapies for breast cancer, inflammatory diseases, migraines, that is what is in the pipeline currently and close to approval. We recommend this company as a strong buy.