Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Whoa! Facebook just blew the market away in such a huge way last evening with earnings that comfortably topped estimates. This has, in my opinion, become the most watched company in the world, possibly eclipsing Apple. We are living and learning as humans to deal with issues of privacy and what is acceptable and not on the internet, most especially social media. Whilst you can post whatever you want, you should think about it deeply.

The revenue number for the last quarter at Facebook is less than the profit number at Apple for the last quarter. As of the close last evening, the Facebook market cap was over half of that of Apple. You can't compare Apples and Facebooks, stop it, that is silly as the great Monty Python characters would say. Let us jump head first into the important numbers. The company recorded revenues of 6.436 billion Dollars for the quarter, an increase of 59 percent on the year prior. Not bad for a company with a disastrous IPO.

Advertising revenues were a whopping 63 percent higher when measured against the same quarter this time last year. Astonishing! Mobile advertising revenues represented 84 percent of advertising revenues, up from 76 percent from this time last year. Remember a time when the company was going to struggle to monetise mobile? They just owned it! Operating margins increased to 43 percent from 31 percent, cost control in place at the social network.

Net income topped 2 billion Dollars (2.055bn USD), up 186 percent from this time last year. Non-Gaap diluted earnings per share clocked 97 US cents. Consensus for the full year has shifted beyond 4 Dollars a share, way higher than anyone estimated a couple of years ago. Like four times higher. Like. And like again. You CapeTonians and Durbanites invented "Like". Except you were too busy watching average rugby teams, that you forgot to patent it, some young geek in a study dorm was liking your like. Like shwow. Ouch, sorry, that was mean. The stuff about patents, not the rugby team.

On a users basis, this company stands heads and shoulders (and knees and toes) above the rest. Remembering that their core and first business is Facebook itself, the (very dumb purchases at the time, remember) other platforms, Instagram, WhatsApp and Messenger are all big hitters in their own capacities. As one stock analyst put it, Facebook has a product roadmap that has no peers. It really doesn't. And monetisation of the other major platforms have basically just scratched the surface. To think that 66 percent of all users of Facebook (monthly users - 1.712 billion) use it daily. And that mobile only monthly users (i.e. no desktop or laptop) is closing in on one billion, 967 million currently, having more than doubled in two years.

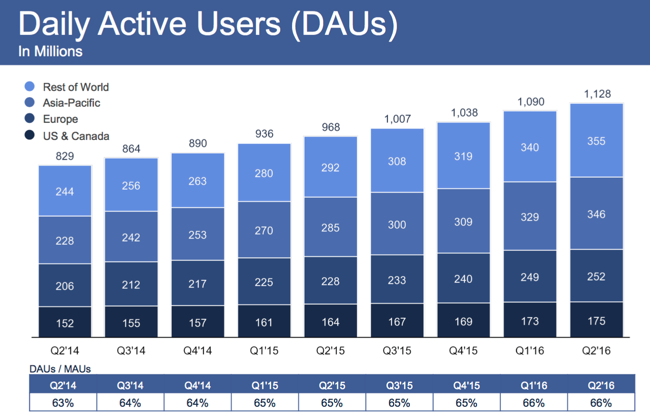

A few slides are worth taking from the presentation, firstly there is Daily Active Users by Geography, just to show the diversification of the business -

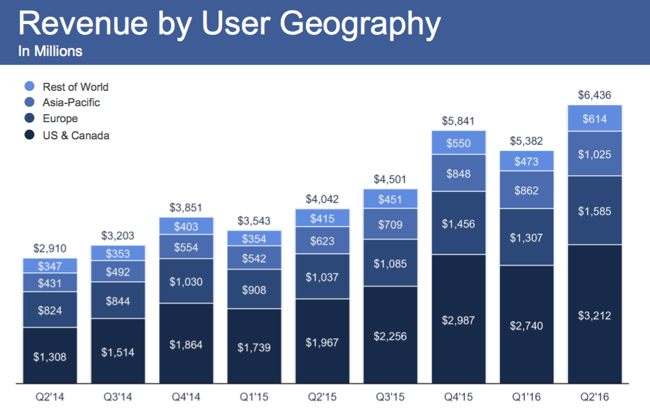

Half of Europe and half of the US and Canada (roughly) using Facebook daily. Which means that there are many others not using the service. Makes you think, not so? And then this graph, whilst there are many users all around the world, logging on daily to check the more awesome lives of their peers and friends, some spend more to advertise than others. It is not surprising that the US and Canada attract larger amounts of advertising than their European, Asian and rest of the world peers.

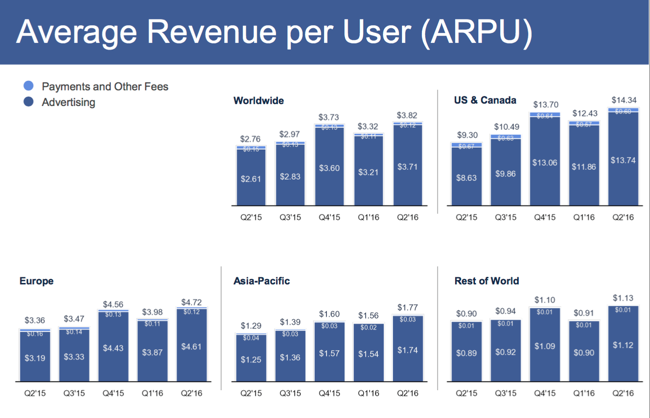

And then lastly, Average Revenue per User, which will beat home the idea that this definitely is a growth business. Note that this is the monthly income earned by the company per each user, in their respective territories. In the same way that the usage numbers for mobile phone companies is measured in ARPU's, the same applies here for Facebook, except it is the advertisers that are supplying the revenue and not the cell phone airtime buying.

It feels strange at an elevated share price of nearly 129 Dollars pre market to suggest that this company is just potentially scratching the surface. The company has tripled in price since their "disastrous" IPO in May 2012, which is not that long ago. I pity the fool (Mr. T) who sold the stock in August of 2012 at around 18 Dollars when they were not able to monetise mobile. Mark Zuckerberg is not finished. Heck, he in many senses has hardly started. He is a long, long away from being close to his vision. We need people like that. We continue to accumulate what is now a stock that is much cheaper than it was before they listed, even though the price has tripled. Capiche?