Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Sometimes markets work in mysterious ways. Last night Stryker beat earnings estimates, but lowered expectations for next quarter. The stock is down 4% premarket. The reason I am perplexed is because they actually raised estimates for the full year. Estimates for the year increased, but the market is only focussing on next quarter. Sounds like an opportunity to me. Long term shareholders will not be too upset however, the stock is up nearly 30% year to date and it is the best performing stock in the Vestact portfolio so far this year. Let us look at the numbers.

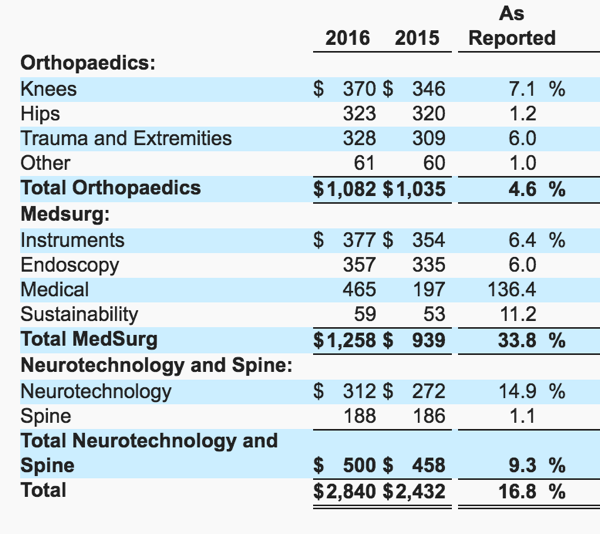

When reporting sales the medical devices business splits their sales into 3 categories. Net sales for the group grew 16.8% to $2.8bn, 6.6% if you exclude acquisitions. The image below not only shows you these three categories but it further details the divisions.

As you can see, the acquisition of Sage Products and Physio Control International had a strong impact on the MedSurg division. If you click on the links and browse through the websites it is pretty impressive seeing all the new products and devices they are coming up with to improve our standard of living. Your body is your greatest tool, these are the devices that will fix it. What bigger priority can you have than the physical well being of yourself and your loved ones? Back to the numbers.

This growth in sales resulted in a 15.8% increase in earnings to $1.39 for the quarter. That is excluding the costs and intangible write downs form the acquisitions. Gross margins are a whopping 66.2% and operating income margin came in at 24.8%. They sure do charge you for these high end products. It is an incredibly profitable business. 10% of these gross profits goes back into Research and Development. Trading at $118 a share and expecting full year earnings of $5.75 the stock trades just above 20 times. Slightly above the S&P500 forward average of 17, and current trailing 19.3 times.

When you look at the quality of the business, I am not surprised. The majority of doctors we speak to rave about their products. If you work in healthcare and have some extra insights please let us know what you think of Stryker products. Having said that, 72% of their sales comes from the US (although they seem to have a decent presence in SA). This presents a good opportunity for global expansion.

Another exciting prospect could come from further acquisitions. There is a huge amount of innovation in the healthcare sector and products are being created all the time independently. Stryker has a market cap of $46bn and is sitting on $3bn in cash. I am sure there are lots of consolidation opportunities.

As you know, we really like the sector, it is changing, growing and getting exceptionally better as we speak. Our job is to find the best companies who are spearheading this change. Stryker is certainly one of them, we reiterate our buy rating.