Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Another company that has morphed along the way, and is older than you think is a business called Netflix. You may already be a big fan, provided that you have the streaming capabilities here in South Africa. Like the providers of smartphones, you are only as good as your service provider. Netflix will be 20 years old next year at the end of August, the company is the same era as the Amazons of the world, listing at a less opportune time in 2002 after the tech bubble had popped already. It is hard to believe that Netflix has been listed longer than Google. With the advent of high speed broadband, the company was able to change from a simple mail and pickup of DVDs (remember those) to a streaming service. It is so big that the company accounts for one-quarter to one-third of all US internet traffic.

The model is pretty simple. Movies and series on demand, as and when you want to watch them, you pay one monthly fee. The company has also evolved from other peoples content to their own original content, some pretty awesome series too. "Orange is the New Black" and of course "House of Cards". The original of the originals. My watching patterns are erratic at best, sport mostly outside of business TV. That always needs to be watched live and always needs to be watched. There are plenty of people looking for different entertainment, and so far, not only have Netflix been able to deliver, they are a leader. Plus, importantly, you can watch the content across all hardware platforms. PC, Apple TV, Xbox, most set top boxes.

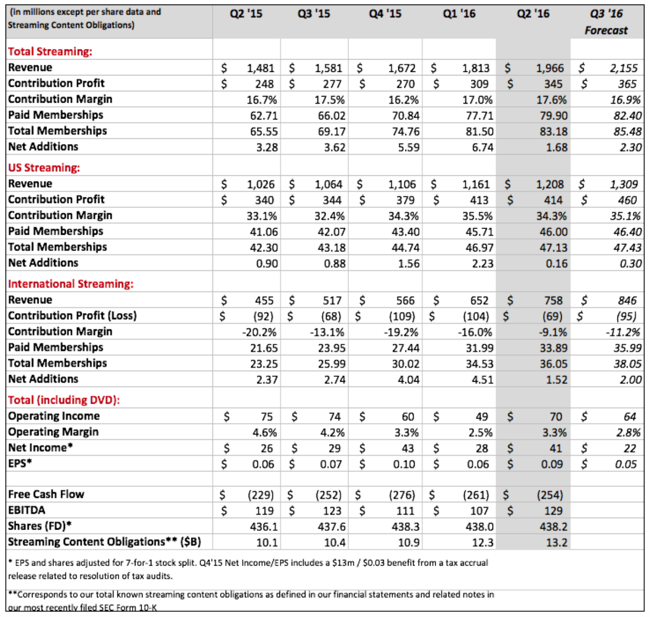

The company announced their numbers post the market two evenings back - Netflix Releases Second-Quarter 2016 Financial Results. Their subscriber base growth for the quarter missed expectations. As they said "We are growing, but not as fast as we would like or have been. Disrupting a big market can be bumpy, but the opportunity ahead is as big as ever and we continue to improve every aspect of our business." Personally, I don't like the word don't and neither do I like the word but. There is lots of competition, they are right. From Amazon, from Hulu, heck, even from YouTube. In fact, YouTube is the biggest streaming service provider in the world, untouchable currently.

Their non-US (what they term international) business is growing like gangbusters. Their core business revenues are growing, perhaps not as much as they would want. And they admit that they are not growing subscribers by the amount that they need and want. Reed Hastings suggests on the conference call that every household in the US may have the service in the coming decades. As ever, the only thing that matters is content, whether it is good or not. Live sports events such as the Olympics are going to disrupt their subscription numbers in the current quarter. These are all the Netflix numbers that you will need, as you can see, the company is profitable, not by too much.

As you can imagine, it matters not whether you have one million or 1000 million (that is a billion) customers, what matters is your ability to be able to continue to grow profits relative to the market valuation. Netflix is NOT going to be a company to own for everyone, there are many questions to answer over the coming years, I am sure they will answer most. The ride is going to be very volatile. Reed Hastings, the founder who stuck in 2,5 million Dollars of his own money at the start (he is now worth over 1.1 billion Dollars). Good work Reed, good work.