"By geography, revenues are 49 percent Asia, 23 percent South Africa (still big), 15 percent Europe, 2 percent Latin America, only 9 percent "Rest of Africa" and lastly "other" is two percent. In terms of where revenues are derived (outside of the segments) it is IVAS (Internet value added services) and Games at 36 percent, subscriptions (to TV) at 23 percent, ecommerce at 21 percent, with advertising at 11 percent. Print, circulation and distribution is a meagre 3 percent"

To market to market to buy a fat pig This British vote to exit the EU is a highly emotive issue. At the core is a changing world, free movement of people and skills. And I am afraid that the older generation, who has seen little by way of wage growth, blame immigrants for their lack of progress. Here is a pretty good summary of what I am talking about -

The U.K. Brexit: Economic Destruction Vs. Creative Destruction. I shall copy and paste one sentence and you can tell me what you think later:

"And when the disruptive innovations are as big, and frequent, as what's happened the last 30 years - globalized economy, nationwide and international super banks, outsourcing, offshoring and the entirety of the Internet of Things - it has left a lot of people really concerned about their future."

I do not agree with the conclusion that Britain is about to fall down a hole. The scenario that he paints is not a particularly rosy one. People can unwind their choices, isn't it called democracy?

Tax payers of all creeds and colours pay the same amount, the law doesn't discriminate in any shape or form of how many tax dollars you pay. Immigrants in all shapes and forms have no plan B. By nature immigrants will work longer hours, do jobs that locals don't want and definitely give more. Uber is a good example of the lengthy hours that immigrants put in, I have driven here, Cape Town, Paris and New York, each and every case I think that I engaged with the driver they were not originally from there.

In Cape Town recently, a man of Zimbabwean origin and a man from Burundi shared their experiences with me, they work six to six and a half days a week, in order to meet their quota for the week. And it is certainly not an 8 hour day, perhaps 50 percent more than that. The one fellow woke up at 03:30 and the other went to sleep around 02:00. The flexibility afforded to these long toured working folks by technological advances of the collective humanity meant that their income and living standards can be raised. By working 60-70 hour weeks, people can change their lot in life and give their offspring a leg up.

Fight technology and globalisation at your peril. I suspect that whilst the Europeans are pushing hard for the English to leave (and making these utterances in German and French now), the leadership vacuum in UK central makes the job harder to negotiate from a position of strength. This may well be seen as another example of the higher powers inside of the European Union wanting to punish the revolters quickly (think Greece austerity). And that may not be the best for all of us in the long run.

As ever, what should you be doing right now? People waking up in England this morning may be feeling sorry for themselves and lamenting their lack of fortitude on the football field, losing to a country of 'basically' fisherman whom they used to lend (and deposit) lots of money (didn't they have a massive banking crisis?), they are still going to need goods and services. They are still going to head off to work.

British folks future may be a little less certain from last week, Google trends have indicated a spike in searches of emigrating to Canada (true story -

Brexit fallout: 'How to move to Canada' trends in U.K. after European Union vote), it isn't as if they are going to all assume the foetal position. There have been pretty dire knock-on effects, immediately the hallowed triple-A rating is gone (she gone!) -

U.K. Rating Cut Two Levels by S&P, One by Fitch After Brexit. Who knows.

To answer the question, do nothing now. Do not react in a way that will lead to the detriment of your long term savings plan. In conclusion, two tweets stand out for me, and they are both associated with one another. This one from Morgan Housel requires a little thinking about, it makes brilliant sense.

And then our old pal Cullen Roche replied, again this makes complete sense. Like everything in life, investing is hard. So is running a business. So is learning for a degree, passing with honours along the way. These are all things that are hard, if they were so easy, everyone would do it.

Investing is like a never-ending marathon, where you get the opportunity to rest and take stock from time to time.

Keep calm, carry on, stay the course and above all, don't be reactionary.

Keep calm, carry on, stay the course and above all, don't be reactionary. The British may indeed change their minds again, whether or not the Europeans may be that accommodating is another question entirely. If you needed reminding, there are candidate member states who want to get into the trade block, heck, Turkey has been waiting since 1987. From an out and out map point of view, Turkey seems an age away. Turkey ticks a lot of boxes.

As ever, there will be a winner in all of this. Paris, Dublin or Frankfurt may well become the capital of finance, or even Zurich, keeping it independent? Maybe? Yes? No? If you wanted to know who the people are -

Check current status.

Scoreboard check. Our market closed just above 50 thousand points. Three percent down on the day. We are around 4000 points lower than recent highs. Incredible, right? In New York stocks were trashed and kiboshed again, down to 2000 on the S&P (down 1.8 percent on the day), the Dow Jones off one and a half percent, whilst tech stocks were beaten up real bad, down 1.8 percent on the day. Astonishing downward moves. This morning stocks are up across the board heavily. Expect volatility to continue, be sanguine and stay the course.

Company corner

It is Naspers time. It is more than a little complicated when trying to review this business, and that is why there has always been various views on why you should or shouldn't own the stock. At a face value the stock from an earnings point of view always looks overpriced. Not all valuation metrics are the same, you value the business based on the future profitability of the business. I suspect that many investors who try and value this business grapple like all of us to try and value what the likelihood of the increased investment in key areas is likely to yield. In other words, heavy investments currently in their classifieds and ecommerce businesses, mean steep losses for the time being. The longer dated investor may well think that this is very necessary for the business to jump to the next stage of investment.

Around two years ago, Koos Bekker cautioned that the TV business may well be a legacy business, it is old school. With improved internet speeds, the roll out of many more channels (think Netflix and their (Naspers) own Showmax) we are seeing the evolution of TV. What is not quite clear in the whole TV on demand thing is where does sport fit into this. You cannot watch sport second hand. You have to watch each and every match live, otherwise you miss something. FOMO is real, most especially for sports fans. We live in times that evolve, and quickly at that. You are more likely to consume more and more media via your handset. Naspers are there and want to be there. I suspect that there will also be a time when people associate the business with the new chief and less so the chairman.

Let us cover the results in several bite sizes, first today the marked impact of the Dollar in their results. Weakness across the board in emerging market currencies led to Dollar being revenues flat, the Dollar strength had a drag of 285 million USD on core headline earnings. In local currencies revenues grew by 22 percent. Listed investments account for nearly half of revenues, 46 percent to be precise (Mail.ru and mostly Tencent), whilst ecommerce is growing sharply, contribution of 22 percent to overall revenues. And then video entertainment, which is the old school satellite TV and Showmax as the newer kid on the block, that is 28 percent in total. The balance, a mere 4 percent is media and other.

By geography, revenues are 49 percent Asia, 23 percent South Africa (still big), 15 percent Europe, 2 percent Latin America, only 9 percent "Rest of Africa" and lastly "other" is two percent. In terms of where revenues are derived (outside of the segments) it is IVAS (Internet value added services) and Games at 36 percent, subscriptions (to TV) at 23 percent, ecommerce at 21 percent, with advertising at 11 percent. Print, circulation and distribution is a meagre 3 percent, it is a wonder that this business is still called Naspers (loosely translated, National press).

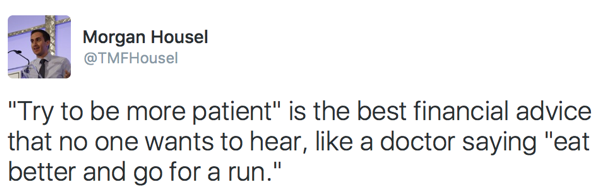

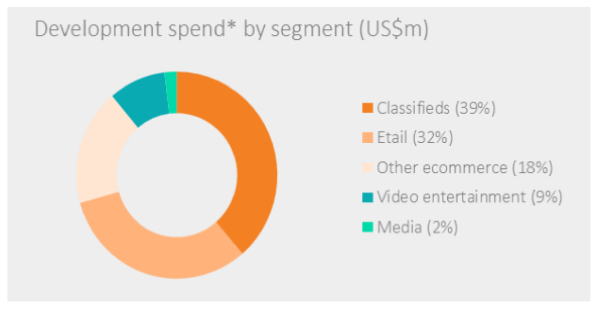

Here is the part that makes it difficult to understand the business, a picture tells 1000 words, in some cases with some iconic ones, more than that. Their development spend is clearly focused on businesses that they think are likely to catch more subscribers and users in the coming years.

Forex swings ate heavily in the absolute development spend in the company, over the last three years Naspers have spent an astonishing 2.265 billion Dollars in their various businesses. In Rand terms that is over 34 billion. So when will these heavy spend yield positive results for shareholders? Perhaps to answer, one has to point out that the company is not always going to get it right. In the most recent results they have written down the value of many assets, including the South American print business Buscape, Konga (an electronic ecommerce business in Nigeria) as well as Netretail, an Eastern and Central European internet retailer.

When you part with your hard earned money and invest in this business, you are leveraging off incredibly smart minds who are following current trends in consumer behaviour and patterns. Think OLX, Takealot, allegro, Flipkart and goibibo. They might not be well known to you, they are parts of other peoples channels. The company will continue to invest in higher growth business models as well as continue to make their respective subscriber bases much bigger than currently. And all of this will take place on the device in front of you, the mobile phone. Why? Increasingly in the areas that the company operates the internet is delivered in that fashion.

We continue to own what is still essentially a proxy for Chinese entertainment business Tencent with maturing other businesses and most importantly very exciting new businesses. This is still one of the best opportunities in our local market, we continue to accumulate this business on weakness.

Linkfest, lap it up

It is probably not surprising that on a square meter basis weed has strong returns for retailers -

Marijuana shops are more lucrative than Whole Foods, by at least one metric. Not though how far ahead Apple stores are, they are streets ahead of anyone on profitability per square meter!

When sales decline marketers need to get creative -

In India, KFC is serving fried chicken in boxes that double as phone chargers

Hedge funds have started getting more airtime recently in South Africa -

Unquantifiable Risk. When investing in a fund there is always more risk than if you invest directly into equities, sometimes that risk is not properly valued.

Home again, home again, jiggety-jog. Stocks are up sharply. There have been many views over the last few days. Remembering that opinions are like you know what. I am not surprised that central banks are talking coordinating efforts.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.