Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

MTN in the news yesterday, firstly the Appointment of New MTN Group President & Chief Executive Officer was met with major excitement by Mr. Market, a man with a lot of experience and deal making activities, here he is - Robert Shuter. As you can see from a well maintained LinkedIn profile, Rob is currently Chief Executive Officer Europe Cluster at Vodafone. He was head of Investment Banking at Standard Bank once upon a time and for a long while was Managing Director for Nedbank Retail, before moving to Vodacom as the Chief Financial Officer.

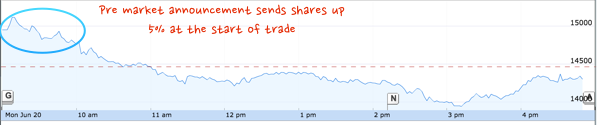

Scroll down a little more, and you will find that Rob is a runner, as well as a competitor in other sports. Over to his Twitter account - @ShuterRob, his short bio is: "4 great passions family, business, health/running and storytelling. Proud husband and father. #LCHF #barefootrunning" Low carb, high fat and beach running is the way I read those hashtags. Perhaps he could do with a whole lot more followers! Do your best and follow Rob, OK? The market seemed to love the appointment, check the intraday graph that I got from Google Finance -

So why then does the price fall away like that? There was another separate event, something that we knew was happening, yet did not know what the quantum of the draw down would be. And in case you are very confused, then look no further than the Nigerian Naira to the US Dollar. That rate used to be fixed by the central bank, at a level of around 200 to the US Dollar. Except that there was a parallel market as it was called, the real rate of what people trade on the streets. See this Bloomberg story - Nigeria's Naira Slide Deepens Even as Central Bank Sells Dollars.

MTN has their biggest business in that country, the impact of lower Dollar revenues (even though in Naira it would be stable) would have to be factored into models. The rate, as you can see, went to around 281 Naira to the Dollar. In a day. The good thing is that the "parallel market" strengthened too, which means that the official rate will likely be the real rate in the end. Whilst this is painful for the people of Nigeria in the short term (it is arguably been set by the market already), from an official inflationary point of view. As hardcore capitalists, we welcome the liberalisation of the Nigerian economy. In the end the people benefit from a free and fair market.