Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

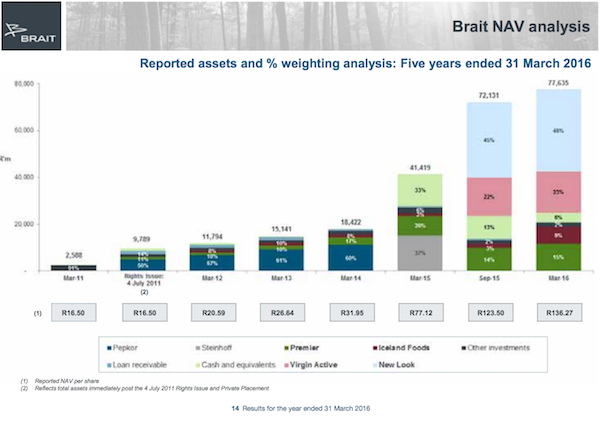

We saw the full year numbers from Brait on Tuesday morning. This caps off another busy year for the investment company with the purchase of Virgin Active, New Look and upping their stake in Iceland Foods from 19% to 57%. Given that the company is an investment company the figure that matters the most for the year is the growth in Nett Asset Value (NAV), over the 12 month period management did not disappoint. NAV went from R77.12 a share to R136.27 a share, a more than "solid" 77% growth.

A big chunk of the gains came thought increases in the value of their investments, the investments grew R22 billion of the total R30.5 billion in gains. Then given that most of the assets are offshore, gains from the weaker currency are around R9 billion of that, so by no means a small number. Here is a quick look at the breakdown of the weightings of each asset, the image is unfortunately poor quality but the colours give you a good idea which are the important ones.

The most important assets are now their two new acquisitions. The value of New Look has increased substantially since they bought it thanks to a reshuffle of debt. Using the balance sheet of Brait, management has been able to reduce weighted average interest cost from 9.4% to 6.3% and extend the average maturities from 3 years to 7 years. This puts New Look in a far stronger position and upping its value nicely.

Some numbers from New Look, their online sales grew by 28%, 41% of woman in the UK have shopped there in the last year and they are adding 50 stores in China to their already 85 stores.

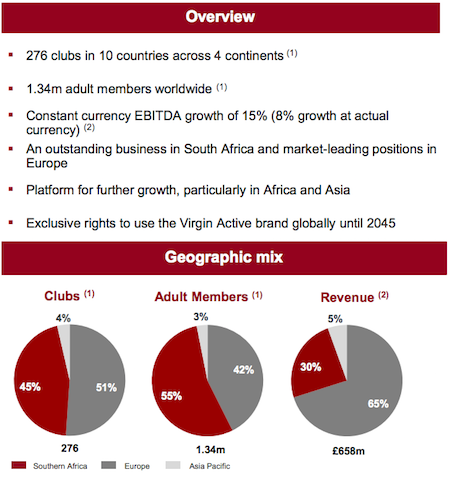

A quick look at Virgin Active in the image below.

Europe is where the money lies for this business, even though South Africa is the bulk of the members is it only 30% of the profits. As the globe becomes more health conscious so will the value of this business increase.

If you want a more in depth look at each of the businesses have a look here - Audited Final Results Booklet. Management have demonstrated through their two acquisitions this year their ability to increase margins significantly, add revenue streams whilst using the Brait balance sheet to the advantage of their subsidiaries. This company is still a buy in our book.