Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

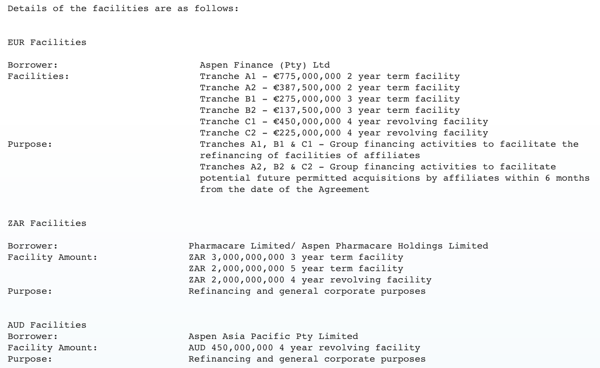

Two sets of news from Aspen yesterday and then this morning. First, the news came yesterday afternoon that the company had obtained funding facilities of 3 billion Euros. I will do a copy and paste of the announcement:

"The Facilities were structured across EUR, ZAR and AUD term and revolving credit facilities with tenors of 2 to 5 years. All facilities were consolidated into a single facility agreement ("the Agreement") with all creditors ranking pari-passu.

The initial launch size of EUR1.5bn for the EUR facilities was significantly oversubscribed (over 2x); allowing Aspen to upsize the EUR facilities to EUR2.25bn and still offer the EUR banks considerable scale-back."

Got it? I think all you need to know is that the company has managed to attract new investors (they say so), across all territories. Most of the debt is in Euro's, some in Rand and some in Aussie. They do lay it out in the SENS (image below), that this of for refinancing, raising money for future acquisitions and general corporate purposes.

And funny that the company points out: "Tranches A2, B2 & C2 - Group financing activities to facilitate potential future permitted acquisitions by affiliates within 6 months from the date of the Agreement" Why? A deal announced this morning. More like 6 minutes or 6 hours we said in the office.

Announcement this morning: "Aspen Holdings is pleased to announce that its wholly owned subsidiary, Aspen Global Incorporated ("AGI"), has signed an agreement with AstraZeneca AB and AstraZeneca UK ("AstraZeneca") whereby AGI will acquire the exclusive rights to commercialise AstraZeneca's global (excluding the USA) anaesthetics portfolio ("the Transaction")."

Price? 520 million Dollars for now and then double-digit percentage royalties on sales of the portfolio. As well as sales related payments of up to US$250 million based on sales in the 24 months following completion. I am copying and pasting a bit here, forgive me for that. The supply agreement lasts initially for ten years.

What are these anaesthetics? Copy and paste time again: "seven established medicines, namely Diprivan (general anaesthesia), EMLA (topical anaesthetic) and five local anaesthetics (Xylocaine/Xylocard/Xyloproct, Marcaine, Naropin, Carbocaine and Citanest) ("the Portfolio"). The products in the Portfolio are sold in more than one hundred countries worldwide including China, Japan, Australia and Brazil. These products generated revenue of US$ 592 million in the year ended 31 December 2015."

The market clearly likes this. Why? As Aspen points out: "Based on the terms of the agreements and Aspen's current cost of funding, Aspen's interest in the Portfolio would have generated a contribution to profit before tax of approximately US$100 million in the year ended 31 December 2015."

The stock is up 8 to 9 percent to begin with today. That is what Mr. Market thinks. We continue to accumulate the stock, this is clearly good news for shareholders.