Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Friday morning we had the full year numbers from Richemont. There were many moving parts to the results but on the whole the numbers were disappointing, the stock dropped around 5%. Here they are - Richemont audited consolidated results for the year ended 31 March 2016. (Investor relations and management do a great job in making these documents easy to read/ use)

To the numbers, sales were up 6% to EUR 11 billion, operating profits down 23% BUT diluted earnings up 67% to EUR 2.2 billion. The operating number doesn't look great due to the prior year having a gain from a once off property disposal and then costs relating to a restructuring. On the Diluted earnings / Net Profit side of things, the big surge in the number is due to a non-cash gain from the tie up of Net-a-porter and Yoox.

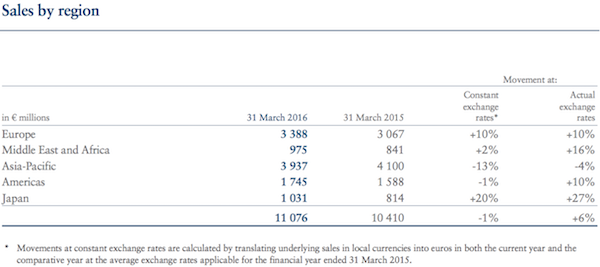

Looking at the sales numbers below, things still haven't normalised in Hong Kong and Macau due to the crackdown on corruption by the Chinese government. The bright spot is there has been strong growth in mainland China, even though it is off a relatively low base, comparable sales for April 2016 are 26% higher than the 2015 number. The big surge in Japanese sales is thanks to a weaker Yen, tourists took advantage of the lower price.

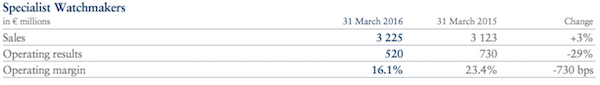

The watch division is where most of the pain was felt, even though sales were marginally up the profit margins were way down. Profit margins for watches were down 730 basis points partly due to the need to lower sales prices to get stock moving.

Over the last year the stock has been re-rating from a growth stock to a defensive stock. In Swiss Francs the stock is down 31% over the last year. Thanks to Rand weakness the stock is down 15% here on the JSE. Due to this rerating the stock now trades on a P/E in the mid-teens reflecting that the market doesn't expect much earnings growth from the company. There is still a premium on the stock due to the defensive nature of their brands.

Going forward only once things have normalised in Hong Kong and Macau will Richemont move back into growth mode. Until then expect the dividend to continue moving higher (the dividend has been upped by 6%) and the stock price to be at the mercies to currency changes. If you are looking for a Rand hedge and a stock that is focused on the international consumer, Richemont is a great option.