Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Luxottica is one of our non-core holdings which requires an extra look after some wild share price swings. To put things into perspective they hit $71.60 a share in October last year after a good run only to close at $54.37 last night. The price in Euros hit 65 Euros in October last year and closed at 49 Euros yesterday. This is not just a currency issue, the share price has been under pressure.

Concerns

The fall in the share price has been a result of a number of factors. The main factor has been the slow down in luxury goods sales in the likes of Hong Kong and Macau. Former high flying areas for the company and the sector. Plotted against LVMH and Richemont, the share price movements downwards form October 2015 are similar.

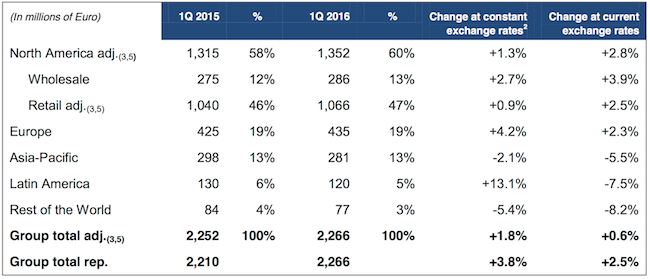

As you can see from the image below, which reflects the latest sales update, Asia representing 13% of overall sales, went backwards. As I am sure you can also see, the currency impact was big in the developing markets they operate in. Although the Euro weekend to the Dollar, it strengthened to virtually everything else. North America is still their dominant market which I would say is a good thing. The US economy is stronger than most and as the job market improves and oil prices remain low, the consumer should get stronger.

Another concerning issue is the ownership structure. Leonardo Del Vecchio is the 80 year old founder of the business who still owns 61.9% of the company. In October of 2014 Del Vecchio had a run in with the long serving CEO Enrico Cavatorta who quit. This caused a bit of a board revolt and some people left. Eventually Del Vecchio was happy to settle with two men, Adil Khan and Massimo Vian, who ran the business as co- CEO's.

At the end of January 2016 Leonardo Del Vecchio forced Adil Khan to quit, paving the way for Del Vecchio to become executive Chairman. Massimo Vian will remain the sole CEO but clearly still reports to Del Vecchio. The share fell 7.5% that day. There has not been much news on that front since but clearly corporate governance is a risk for this business. At least your interests are certainly aligned with the man running the business.

The last risk I would like to touch on. The stock still trades at 25 times this years earnings and 23.3 times next years earnings. This implies a 9.4% growth in earnings. The company is expensive on that type of growth.

Positives

They have an incredible array of brands and completely dominate glasses around the world. The stock ticks many great boxes.

Healthcare is a strong theme, people's eyesight is crucial to their standard of living and Luxottica's prescription business is at the forefront of innovation in this regard. They are busy constructing 3 new laboratories for the production of ophthalmic lenses. (According to Wiki these bend light to correct focusing defects of the eye)

Fashion and soft luxury will also be huge theme going forward. Sunglasses are a massive fashion accessory and will continue to do so. Plus they do actually protect your eyes and perform a function, unlike luxury watches.

They are the leaders in eyewear for sport. I suspect this will be a strong growing theme around the world as people get more active. Golf, cycling, running and many other activities require good eye protection.

Sunglass hut is a great retail store and has a strong presence in most shopping hubs around the globe. They are also on top of the shift to ecommerce. The groups online retail is flying, growing sales by 17%

Conclusion

This is a fantastic business facing a short term cycle slump in soft luxury. Currencies move in cycles and so do consumer demands. Great businesses like this will ride those waves. People will still be wearing glasses in 50 years time. In fact according to Mark Zuckerberg, smart glasses could be the next big wearable device (they just have to look less dorky than Google Glass). The Luxottica brands will continue to thrive in this environment. We continue to hold and are happy to add for more adventurous clients.