Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Vodacom reported full year numbers on Monday. The company traces its heritage back to the dawn of democracy in South Africa, I had the pleasure of being at a dinner birthday function and sat with a man who was part of the team that wrote that there would be a maximum (at the time) of 250 thousand users of the mobile service. Phones were big and clunky and took calls only, remember? It is a little difficult to believe that the touchscreen smartphones are not that old, and in terms of being mainstream, less than a decade. The iPhone is not even 10 years old. Remember the Symbian operating systems on the Nokia? Remember Nokia? Remember Windows phones, how huge that was going to be. It is Android and iOS now, to be fair there are others, not as dominant as these ones.

So why is this at all important for Vodacom? The more amazing the hardware and software, the more chance there is of consumers using more of their services, in particular more recently data. We dredged up an ancient video of us picking up a Nokia N97 and predicting more people would use the device more. And encouraging the investment in MTN, that has been the company that we have owned for years. For the time being we have been very wrong on that one, Vodacom has comfortably outperformed MTN on the returns stake for quite some time now. We continue to remain patient and await the resolution of the pending fine in Nigeria. Whether or not you think that the quantum (we don't) of the fine is "fair" or not, that is another question entirely.

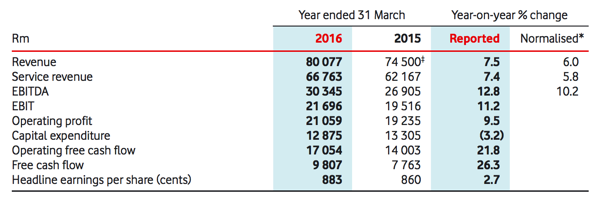

Back to the results at hand, annual ones for Vodacom. Herewith a table with the comparable year:

Whilst Vodacom is not a broad part of our client portfolios, it certainly does have an important place. Even if earnings don't show material moves higher, the company is likely to continue to show good dividend growth. In an increasingly volatile world, locally that is. Having said that, the company still has a large portion of their earnings in South Africa. Which is seemingly MUCH better than being in Nigeria, even if only for the next little while. We are still buyers of this company for our higher yielding portfolios.