Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

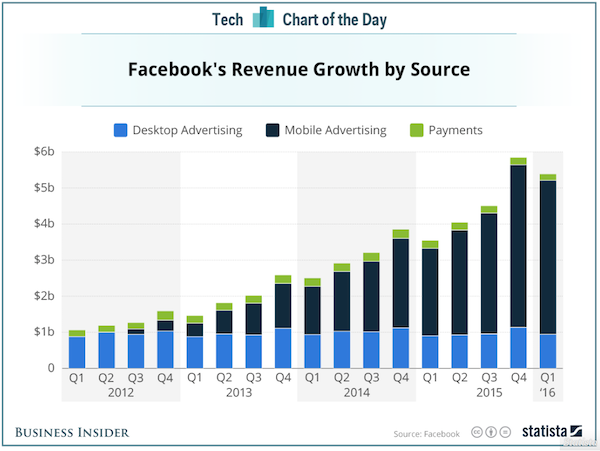

On Wednesday Facebook released their 1Q 2016 numbers and they smoked analyst expectations. The stock was up 7% yesterday. Here are the numbers, Revenue for the quarter is $5.4 billion, up 52% YoY and Net Income is $1.51 billion up 195% YoY, so still huge growth coming through. The big driver of growth has been on the mobile front where revenue grew by 73% and now accounts for 82% of all revenues, mobile is also more profitable than your PC adverts. On the advertising front their average price per advert is up 5% and impression rates are up 50%, both due to a higher mobile to PC mix (adverts on your phone are in your face, where on PC they are to the edges of your screen). Have a look at the huge revenue growth from Facebook since it listed.

Here are some more huge numbers from the company. Monthly Active Users (MAU) is now at 1.65 billion people of which 1.09 billion log on each day! The average US mobile user spends 30 minutes a day on Facebook and if you include their other apps like Instagram and Messenger (not WhatsApp) the number jumps to 50 minutes a day on Facebook content. Some one pointed out on Twitter yesterday that with a following of over 1.6 billion people and an average interaction time of 50 minutes, Facebook now rivals most world religions.

Where will the growth continue to come from? At the moment the Average Revenue Per User (ARPU) is $3.32, if we zoom into the US it is $12.43, in Europe it is $3.98 and the Rest of the World only $0.91. On a global front we will see more advertisers turning to Facebook, with the result being that ARPU's start to look more attractive for areas out side of the US. In the US itself more advertisers are including mobile advertising as part of their advertising budget, with Facebook saying the shift has been from "should we use mobile to how do we use mobile". All regions had more than 50% revenue growth rates in constant currency, amazing global growth. All this growth is not cheap as you can imagine, the forward P/E of the stock is 25. As Facebook keep up all this growth, their P/E will quickly get into the teens and probably a small dividend being paid. Facebook is still a buy in our book.