Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Kevin Plank started Under Armour (UA) in 1996 in his grandma's basement with a goal to create workout and performance wear that's much better than cotton T-shirts. His first prototype was a sweat-wicking compression shirt. Today it has gone further than active wear with added products such as MapMyFitness & MyFitnessPal into their product portfolio.

The American sports & apparel company is a strong competitor to Nike and Adidas especially on the footwear side of things thanks to Stephen Curry. To those who don't know the guy, he is the professional basketball player in the NBA playing for the Golden State Warriors, the reigning Most Valuable Player of the NBA. He has set the basketball world alight with his amazing scoring ability in recent seasons and according to Wikipedia he is the best shooter in the history of basketball (who would beg to differ because the numbers don't lie.)

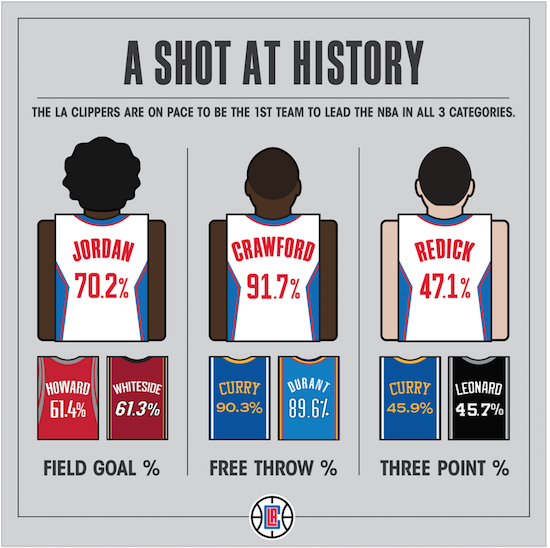

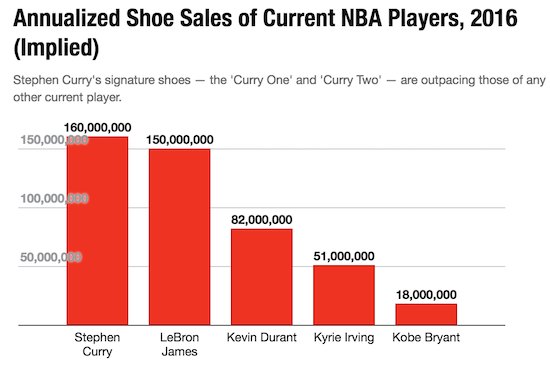

UA footwear business now contributes 17% of total business. The company made $677.7 million in revenues representing a 57% jump year-on-year in the 2015 year end. Analysts (Sole) estimate that Curry adds $14 billion to UA's market-cap, and could even rival Michael Jordan's worth to Nike, according to Business Insider. Just to put things into perspective UA's shoe sales have increased over 355% YTD and Stephen Curry signature shoes business (Curry one & Curry two retailing for $120-$130) is already bigger than those of LeBron James, Kobe Bryant, Kevin Durant, and every player in the NBA except Michael Jordan.

UA also have sponsorship agreements with Tom Brady, Lindsey Von, Jordan Spieth, and Dwayne "The Rock" Johnson, but now we all know which one brings home the bacon!

After Under Armour's great run the CEO Kevin Plank and his team decided they will have a share split on the 7th of April 2016. The split will be a 2-for-1 meaning the for every 2 Class A shares you will get 1 Class C shares. The Class C shares will trade under the share code UA.C, these have no voting rights, and the Class A shares will continue to trade as UA.

UA is currently trading at a historic price to earnings ratio of 81.6, pays no dividend and has a market capitalisation of US$38.26 billion. This means Mr. Market expects Kevin Plank and his team. . . pardon me I meant Steph Curry, Tom Brady, Jordan Spieth, The Rock, and team to grow earnings sharply in the near future. I guess this is not impossible for a company that is expected to grow at around 25% for the next four to five years. Their earnings call is due on the 24th of April, this will be a great indication if the company can maintain the plus 20% expected growth going forward.

UA is definitely not cheap at current levels compared to Nike which has a business thats almost four times bigger, pays a dividend of 1%, and has a much broader geographical reach and brand loyalty. Nike trades at a price to earnings ratio of 28 and is also growing earnings around that double digits range. However we continue to hold UA as a second tier position in the name of growth, especially as they start diversifying out of the U.S market. This is a good one for the long-term as we get more active in the quest for better health and longevity. UA is up a mind blowing 365% in the past 5 years, with that said note that we buy Nike first before venturing into UA.