Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Nike did it last night. Nike have been doing it since January 1964. That is over 50 years of doing it. The name change from Blue Ribbon Sports to the name we know today took place in 1971. Bill Bowerman (co-founder) was Phil Knight's coach. Phil Knight had a personal best of 4 minutes and ten seconds for a mile, that is no mean feat! Bowerman was a spectacular coach, and according to Wikipedia, trained 31 Olympic athletes. As well as 16 folks that managed to go under 4 minutes for the mile, the holy grail of middle distance. As Wiki points out, if you do the math, under 4 minutes for a mile means that you are moving at 24.14 km per hour, or 14.91 seconds per 100 metres. The current record for that distance, the mile, belongs to legendary athlete Hicham El Guerrouj of Morocco, who ran 3.43.13 for that distance in 1999.

We digress, it was supposed to be third quarter numbers for the 2016 financial year -> Q3 2016. Revenues were light, up 8 percent to 8 billion Dollars (expectations were 8.2 billion), excluding the stronger greenback, revenues were 14 percent higher. Diluted EPS clocked 55 cents, up 22 percent and a comfortable beat relative to expectations. 2 percent fewer shares in issue to report on, thanks to some strong buybacks recently. Future orders, i.e. those placed already, grew 17 percent globally, excluding the currency. Including the currency, which you have to, future orders grew 12 percent. Gross margins were flat at 45.9 percent, their tax rate fell, as a result of increased sales outside of the US.

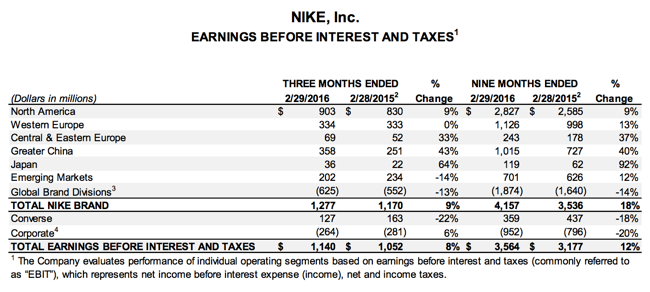

Herewith their EBIT breakdown in the table below, as you can clearly see the massive growth in China, it is now their second biggest territory after North America. With future orders from greater China up 28 percent in Dollar terms, this is fast becoming a bigger and bigger part of the Nike stable.

There I thought China was finished. Perhaps all the people are buying shoes in order to run away from there? For interests sake, revenues in Europe are 50 percent higher than the Greater China region, Chinese profits are better, just a touch. Cheaper rent, cheaper staff, proximity to manufacturing, perhaps even higher selling prices as a result of higher demand, it really is pretty astonishing.

On the conference call (Courtesy of SeekingAlpha -> CEO Mark Parker on Q3 2016 Results), Andy Compion, the chap in charge of the Nike brand (the president) had this to say: "I was just in China three weeks ago, and I can sum up my visit in one word, amazing. Our brand and business in China have never been stronger. And we continue to build momentum. That's not by accident."

The company is still pretty much a footwear company. Sales of footwear represents 61.28 percent of total sales, apparel is 28.29 percent of the total sales. Equipment, over 1.1 billion Rand represents the balance, 4.5 percent. Are those like running arm bands and the like? Further investigation reveals that it is actually hats, sun glasses, soccer and basket balls, back packs, golf bags, beanies, towels, golf clubs, baseball mitts, even lacrosse gloves. Everything that isn't clothing or shoes basically. The company supplies equipment, apparel and shoes for 13 different categories.

The headlines will read that they didn't do it. As Paul points out, this is another quarter of strong earnings in excess of twenty percent growth off a big base for a mega cap. What is actually not to like? We should be so very happy then that whilst we are in accumulation mode that the stock traded lower by 6 percent in the after market. The company continues to be at the cutting edge of innovation, they recently had a two day event showcasing the best of the new, including the USA Olympic uniforms. The company is pretty ruthless, when their athletes get into trouble, they drop them like hot a potato. Which is right, I want to associate the quality with a brand that prides themselves on excellence, not bad behaviour. People like Roger Federer and Serena Williams.

The stock is down, it trades on a lofty multiple of just over 30 times. I think for a growth company that has massive potential in mainland China, to turn that into their biggest destination, this continues to represent a massive opportunity. It is a serious growth business, and whilst the recent quarter looks mixed, the long term story of growth and quality remains intact, we continue to buy.