Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

MTN had results on Thursday, these were for their full year to end December, in what has been their toughest year in a decade and a half. I remember all those years back when they seemingly overpaid for a licence in Nigeria, only for it to turn out to be genius. We looked, we watched and we tried to understand what the market is making of the fine, the unresolved issues. I have chatted to many people about South African businesses going about their work in that territory, let us just say that it is strained at best. It is a bit like that here, somehow we pretend to stand together as a continent, in reality however the situation is different. Each territory has their fair share of challenges, each territory has a separate regulatory environment, in fairness all trying to achieve maximum coverage at a fair rate for their people.

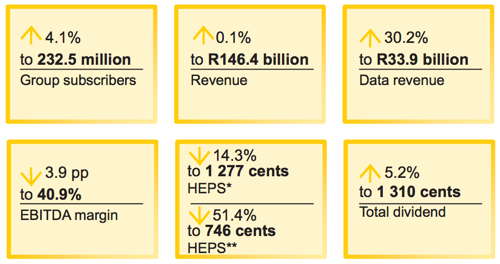

Here are the numbers, let me take the slide from the presentation in order to give you the breakdown of all the moving parts.

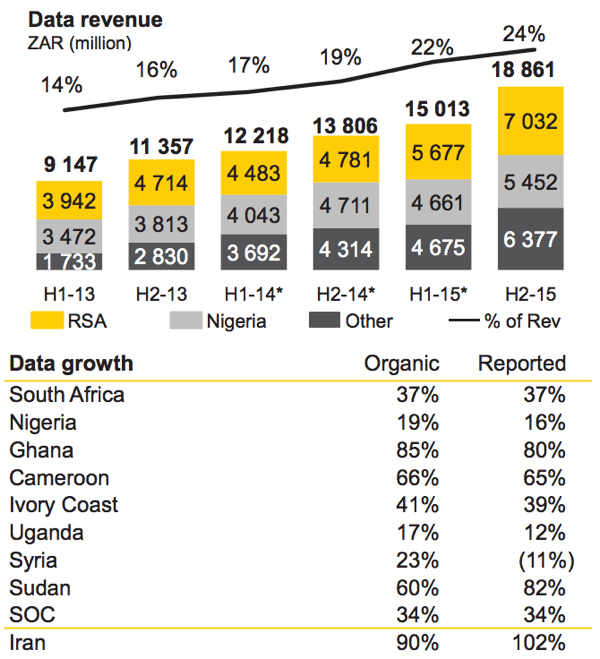

There are many factors here that have contributed to the pretty average year. Economic slowdowns in many of their core territories, Nigeria has had a very bad time of it, weaker oil prices have contributed negatively to their general outlook. The budget is under immense pressure in Nigeria, recently "things" have improved. Equally in South Africa it has been tough going. For a company that has been under significant pressure however, they were able to roll out nearly 30 billion Rand of capex. They have to invest heavily in their network, data revenue is (as you can see) the future of the business. See the image below.

The trick is in the interim to be able to offset shrinking voice revenue with sharply growing content hunger from their customers. What is true however is that data consumption is still very low in developing countries, most especially where MTN operates. It still amazes me how much the network sucks up with regards to handset subsidies, the company spent 10.8 billion Rand on handset costs and other accessories. People obsess with their handsets.

The fine is important to talk about. Remember that the company has paid a goodwill 250 million Dollars to the Nigerian authorities. The company took a 402 cents per share provision for the fine (9.287 billion Rand). That is not the full extent of the fine that the Nigerian authorities are looking for, so why make a lower provision? That is around 600 million Dollars, comfortably short of what the Nigerian Communications Authority are "looking" for.

There has certainly been recourse against the folks who have dropped the ball, obviously Sifiso Dabengwa being the highest profile. The currency issues in Nigeria concerns me too. The official rate from the government (the unicorn rate I call it) is around half of the real rate (others call it the black market rate). This indicates that nothing is working properly. The company does plan to list some of the entity in Nigeria, I am guessing that will appease some of the folks in Nigeria, direct ownership changes everything.

Nigeria worries me as a territory to do business in the short term, in the long term I think that the story is still intact. There are millions of people across MTN's operating territories who have poor mobile connections (for data), average handsets and limited resources. This is however improving, the company is sinking billions of Rand into their infrastructure. As these countries grow at above global growth rates (it will return), the average person will use more of the likes of MTN's services.

There is NO fixed line infrastructure to speak of across the continent, very few landlines. In the very short term the picture looks muted, growth is not there, the dividend is unlikely to be sparkling this year (the company guided to around 7 Rand for the full year) and their operating countries economies are struggling, relative to where they were. Whilst one could possibly "do better" in the short term, if you hold them, keep the stock, the company will resolve their issues and they are definitely still in a growth industry.