Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Bidvest reported numbers yesterday morning before the market opened. We laughed in the office, there are supposedly so many similar characteristics when comparing arguably the best allocator of capital ever, Warren Buffett and Bidvest founder Brian Joffe, one of the best allocators of capital this country has seen. At least for the last generation, he has certainly done an amazing job, Joffe. The two companies reported on the same weekend, that can't be a coincidence, it was meant to be, hence the fact that we were having a good chuckle, Joffe often is called South Africa's Buffett.

Some of the numbers quickly, this was for the first half of their 2016 financial year, ending 31 December. Turnover for the half was 114.5 billion Rand, an increase of 9.6 percent, headline earnings per share increased 13 percent to 1001.5 cents. The dividend increased by marginally more than that, up to 482 cents per share. Net asset value (NAV) climbed 22.2 percent to 128.97 Rand a share. The Buffett metric that he always uses is that if the share price of Berkshire falls to less than 120 percent of book value, he is happy to buy shares back. NAV and book value are two very different things. It is however not unusual for quite a few holding companies to trade at a premium to their NAV. In this case, with the Bidvest share price closing at 357.29 Rand, the stock trades at a significant premium to their NAV.

Segmental breakdown quickly, firstly in terms of sales from South Africa, which contributes 45.2 billion of group turnover, automotive had understandably a tough year, registering a fall of 1.1 percent to 12.149 billion Rand. That division includes dealerships for almost every brand South African motor vehicle enthusiasts could ever think of, from Alfa Romeo to Toyota, Ford to BMW. It also includes Burchmores and McCarthy. The biggest business in terms of revenue contributions on South Africa is Freight, again this business had a real tough year, up only 1.7 percent when measured against the prior half year. As a separate division, the South African business managed to increase revenues by only 3.1 percent for the first half.

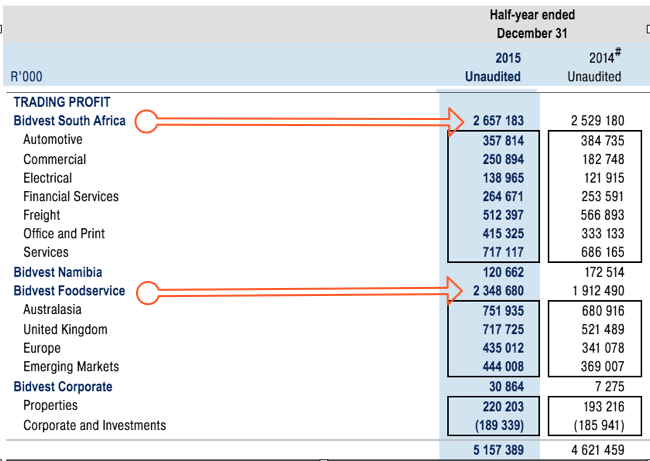

And then the all important Foodservice business, which grew revenues by 14.6 percent to 68.2 billion Rand, 30.3 billion Rand of that is the UK (up 27.3 percent increase on the comparable half), 14.4 billion Rand is Europe (up 13.4 percent), whilst Australasia was disappointing, revenues falling 2 percent to 14.5 billion Rand. The balance is the emerging market segment, which includes China. This business is going to be separately listed on the JSE after being unbundled from Bidvest, shareholders and the regulators have to give it the stamp of approval. From a profits point of view, the South African business, as you can see has lower revenues, higher trading profits. Here is the segmental breakdown of trading profit. It is important to note that the overseas businesses were flattered by the Rand weakness, relative to the Euro, the Pound and of course the Dollar (Asia).

The first thing I noticed is that relative to some of the other foodservice businesses, the Australian one is very profitable. It has higher trading profits than the UK business on less than half of the turnover. Equally the emerging market segment is quite profitable. So is the South African business. Which one has better growth prospects, however? Obviously the global Foodservice business, and I think that as a separately listed entity it may garner a higher multiple.

Does Bidvest however have peers in the global foodservice business? In the US there is a business that is roughly three and a half times bigger than Bidvest, Sysco, which trades on quite a demanding multiple of above 30 times historic, that unwinds to 22 in the current financial year. The yield is not bad at 2.8 percent currently. And forward to next year the multiple unwinds even further to less than 20 times. There is an unlisted business called Dot Foods, revenues of more than 5.5 billion Dollars makes them bigger than Bidvest. Unlisted however. There is another business called Houston's Inc. in the US that is also a competitor. Unlisted again. Equally, another business called Lagasse, Inc. the same applies, in the US and no listing. Wow. Makes you wonder whether or not Bidvest can do this expansion, if they want to have a go in the US. Big market though!

There is a big business in Europe (it is quite global too) called BRF, it is a Brazilian business in terms of its roots. The ADR listing according to Google finance says that the company trades on a 18 multiple, the market cap is over 10 billion Dollars, it is bigger than Bidvest. The share price in Dollar terms for BRF is down 44 percent over the last 12 months. I guess all of these businesses compare favourably to Bidvest, they do have on their side the ability to grow in Europe and Asia, which are different for two reasons. One, formal food services businesses have loads of room to grow, and secondly, perhaps there are cheaper businesses in Europe that are up for grabs. i.e. Cheaper prices, as Bidvest have demonstrated they can obtain.

Brian Joffe is however going to step down as CEO of Bidvest, he no doubt will be there in the background in a Jannie Mouton is to PSG type mould. Lindsay Ralphs who is head of the South African business is going to lead the new company, he is not that much younger than Brian Joffe, less than a decade. Joffe will stay on as an executive chairman in the foodservice business (and a non-exec in the Bidvest local assets), dealing with acquisitions as and when they arrive. Here goes a CNBC interview, where Bronwyn Nielsen interviews Brian Joffe -> Bidvest's founder Brian Joffe explains his future role in the group. Our first instinct is to hold the Foodservice business when it is unbundled and scrutinise the local business, seeing what value unlock there could be in the short to medium term.