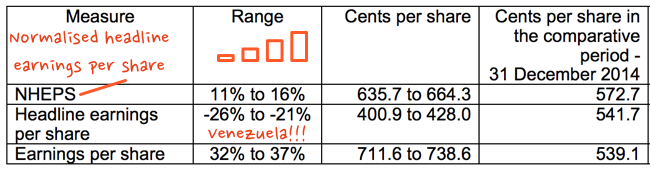

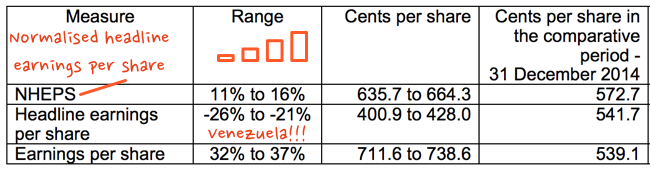

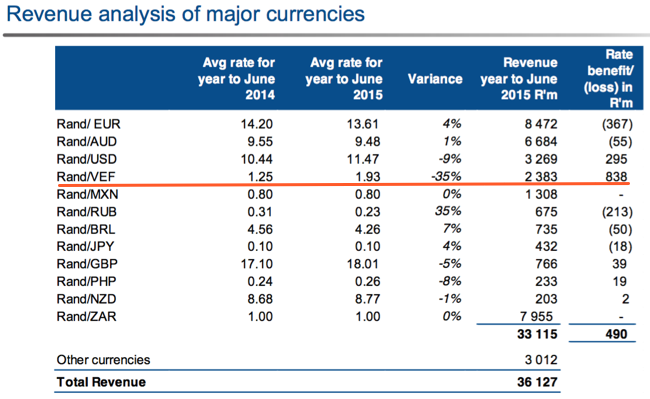

Finally. And by that I mean the share price of Aspen Pharma moving northwards in a serious manner. Year to date the stock is still down 6.62 percent, the move yesterday was up nearly nine and a half percent. The stock is up over 21 percent in less than two weeks. As we pointed out, the stock is still down year to date and over the last 12 months the stock is down over 31 percent. 5 years? Up 246 percent. As ever with stocks, it depends where you draw your line in the sand when measuring performance. Why has the stock moved so much in the last little while? Yesterday the company released a trading update, we can do a copy and paste of the table from the SENS announcement:

Nice graphics skills, right? Learnt everything I know from Paint Shop Pro version 3 I think, more than just a while back. Nowadays since I have been using a Mac for a number of years now, I use Pixelmator. That name always reminds me of the hillbilly tow truck from Cars. OK, what does this mean, why is there a discrepancy between the different numbers? They (Aspen) say the following: "In order to provide Aspen shareholders with clear comparability of the financial performance of the ongoing underlying business, a measure described as comparable NHEPS has been determined by excluding the contribution from the Divestments." NHEPS being normalised headline earnings per share.

They have decided to do the right thing. And by that I mean take the real rate on the streets (most people refer to this as the black market rate, I'd like to think people are betting at setting markets than governments) in Venezuela. The company fleshes it out:

"The economic situation in Venezuela has deteriorated over the 6 months to 31 December 2015 and the Venezuelan authorities have increasingly limited authorisations to pay for pharmaceutical imports using the official CENCOEX rate during this period of Venezuelan Bolivars ("VEF") 6.30 per USD. As a consequence of the limited payment approvals and the uncertain economic and political situation in Venezuela, Aspen has concluded that it would be more appropriate to apply the SIMADI exchange rate of VEF 200 per USD to report the Venezuelan business financial position, results of its operations and cash flows for the 6 months ended 31 December 2015. This has resulted in a once-off currency devaluation loss on foreign denominated liabilities of R841 million."

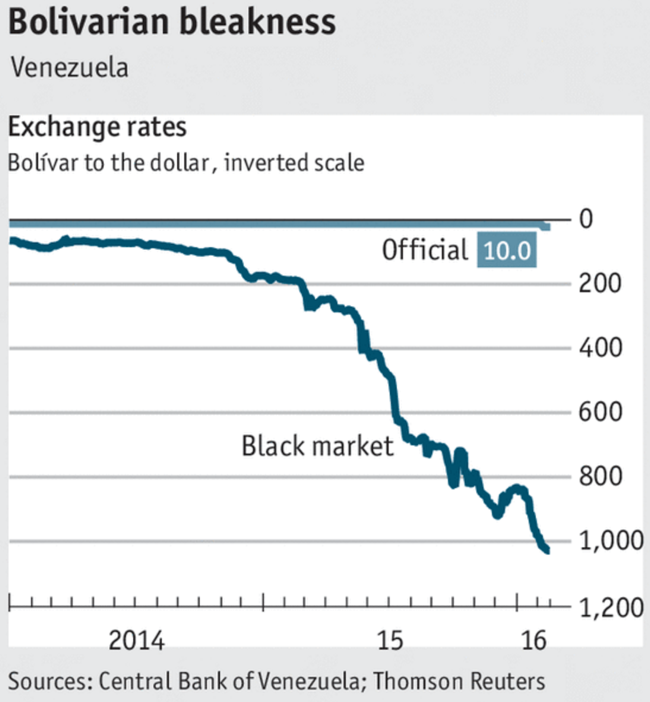

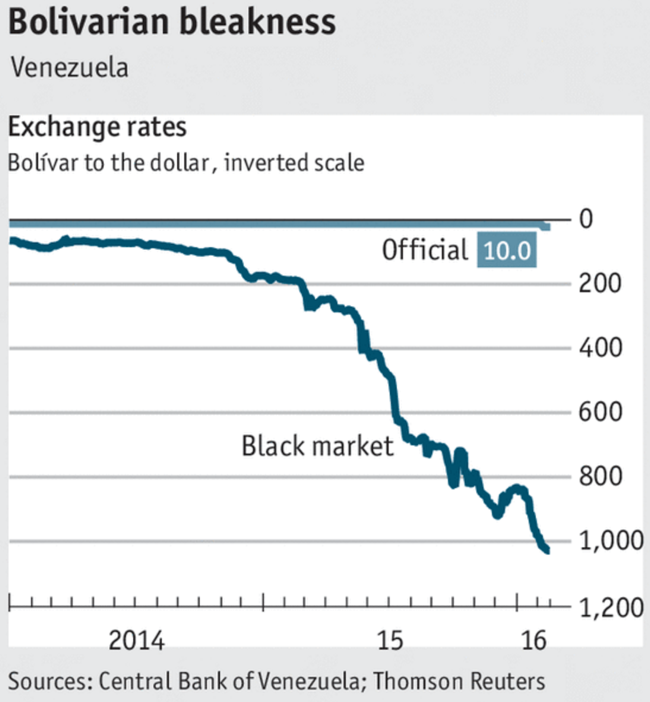

How badly has the official rate changed from the real market rate? This is a graphic (very graphic) picture of the divergence of the street rate of the Bolivar to the US dollar, versus the made up rate by the socialist folks who live with their heads in cloud cuckoo land. I am sorry, let me rephrase that, the black market rate versus the official rate. Here is the best hedge I can think of. Take your Dollars, swap them to Bolivars at the

black market real rate. Go to the government bank and try and swap your Bolivars to Dollars at the

official rate unicorn rate. If you are successful, repeat. Over and over. In reality, this is impossible, you cannot do it.

As you can see as per the graph below, 200 Bolivars to the Dollar being wrong. See this graph below from the Economist article:

Venezuela: a nation in a state.

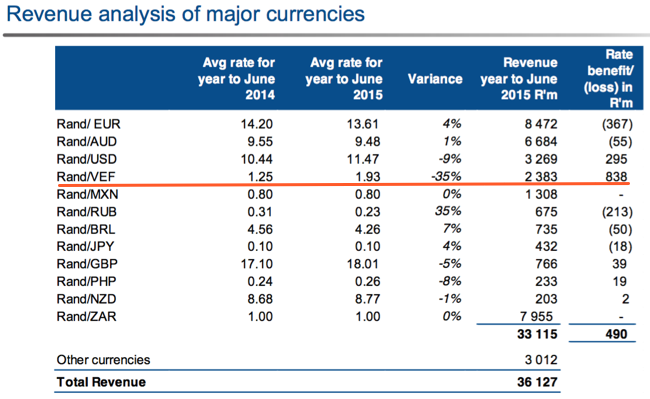

Wow. Venezuela is not likely to default this year, but if the oil price stays lower for longer, it is inevitable. The Venezuelans owe the Chinese 17 billion Dollars. If the Venezuelans do default, it would be the second biggest default of all time, after the Greek restructuring in 2012. So there may well be more pain to be experienced in this geography. Herewith, from the final year presentation, you can see that Venezuela is an important contributor to the overall revenue of Aspen, the fifth largest here.

I will be interested to see when the company reports numbers on the 3rd of March. For the time being the company seems to have beaten market expectations handsomely. We will report back then on the company and their prospects, which we still continue to believe is one of the best opportunities in our local market.