Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

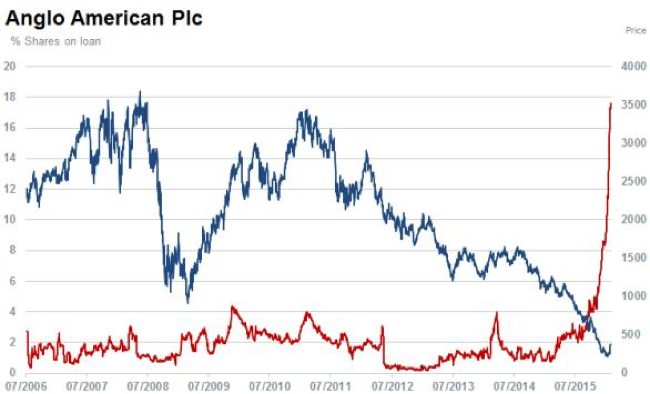

Anglo American was at the top of the leaderboards again, the stock was up a stunning 8.27 percent, following on from the nearly 15 percent gain on Friday. Michael told me yesterday (via a tweet) that short interest in the stock had risen to 18 percent. And almost all of that is recent, stunningly recent! Check it out via Markit: Most shorted ahead of earnings. I cannot believe the ruthlessness of the market, having built in an enormous amount of short interest. There is only one other stock in Europe that has a bigger short interest built in than Anglo, and that is a business called Vallourec. I suppose it is no coincidence as the market has returned to confidence mode that this company saw their share price up a whopping 16.67 percent yesterday.

Back to Anglo, I think it is worth having a look at the visual via Markit, of how recent the short interest has built. For those of you struggling with the concept, it is simple, people sell the shares short, borrow the shares in order to sell them, and then hopefully buy them back at a lower level and pocket the difference. You obviously have to have willing lenders of the scrip, in order for people to be able to sell first (they need to borrow the scrip from a long term holder), this earns the long term holder a fee, marginally more. If the short sellers use leverage i.e. use borrowed money to amplify their returns or losses, the swiftness of the moves can catch you off guard. Check it out, courtesy of the folks over at Markit, link above:

The Y axis on the left hand side is percentage of the share outstanding that has been sold short, the Y axis on the right hand side represents the share price in Pound terms. The ten year graph, the blue line, looks like a train wreck. And to rub salt into the wounds, last evening I saw a story via a Bloomberg commodities reporter, Javier Blas, that Moody's downgrades Anglo American's ratings to Ba3; negative outlook.

Moody's suggests "that the company now faces a higher business risk due to deterioration in commodities market conditions and a longer and more uncertain deleveraging period than previously expected." The ratings agency notes that the company is working hard to reduce debt, suggesting however that it may be hard to sell certain assets in the current environment: "Pending further announcements by the company, the rating agency believes that divestments of non-core assets would be difficult to execute in the current environment, particularly at valuations to allow deleveraging from the current level."

This is all relevant as the company delivers their plans today, along with results. It may be the unfortunate part of the deleveraging cycle which results in mine closures, job losses and reduced exports. All unfortunately in response to lower demand and cheaper supply from other sources. To paraphrase another Latin saying, Quo vadis? Which means, where are you going? The phrase actually takes on biblical connotations, where Saint Peter was said to have been asked by Jesus where he was going. You can apparently visit the site where a church resides, true story: Church of Domine Quo Vadis. Next time one is in (or near) Rome, OK? When in Rome .....

So what now for Anglo? Once the mighty, now a shadow of its former self, wait for the results today. Until recently the company was far bigger than the likes of Bidvest, Sanlam, Remgro and Aspen. Whilst it may appear a tragedy that the company will have to retrench multiple workers, one must not lose sight of the fact that Bidvest employed nobody when Anglo was at the top of the pile, that company now employs 141 thousand people around the world. Aspen employs fewer people, still, at nearly 10 thousand, most of these jobs are relatively new. Remgro and Sanlam are important parts of the local economy, more so now than 20 years ago. So whilst we can harp on about the loss of a giant, it is important to note that many giants have been created over the time that we have seen slippage in the mining industry. And as we often say here, at least we have a better diversified economy than many other countries in the commodity markets. Think Saudi and Russia, who meet today to discuss output cuts. As such the oil price has rallied hard in recent sessions.