Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Stryker, the medical devices business, reported numbers last week, and guided for the year ahead -> 2015 Results and 2016 Outlook. As you can see at face value, the company had a tough year, still, it was definitely acceptable. Total sales for the year, net sales, nearly topped the 10 billion mark, 9.9 billion Dollars, net earnings of 1.4 billion Dollars was achieved. On an earnings per share basis the company chugged out 3.78 Dollars, at 99.30 Dollars where the stock closed last night it trades on a historical multiple of 26.2 times, not cheap by any stretch of the imagination.

There is a reason why the company trades where it does, Mr. Market always knows something. The company guided for the full year ahead, sales growth of around 6 percent in Dollar terms, earnings per share is expected to be 5.50 to 5.70, which means that earnings are growing by 45 percent plus. And forward, the stock trades in the region of 17 to 18 times earnings, which is about where the market is currently trading overall. So the stock price is bang on, spot on, relative to their growth prospects, at the moment.

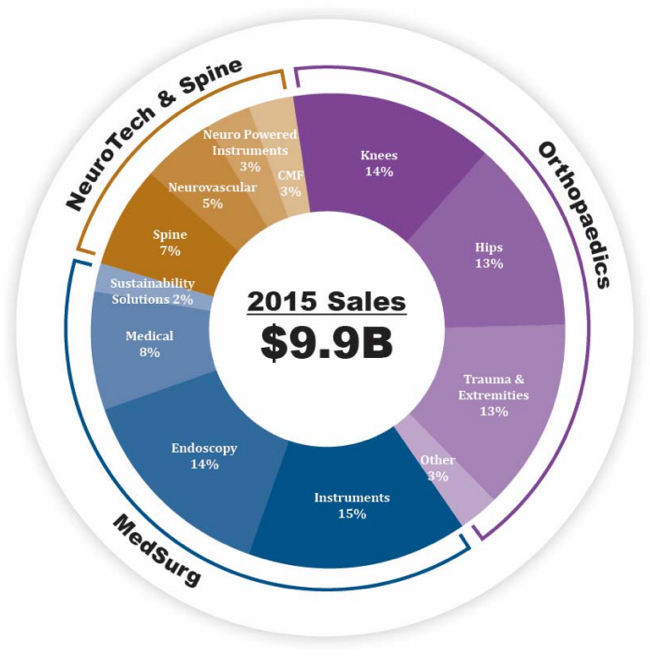

The company has three defined divisions, their biggest from a sales perspective is their Orthopaedics division, then Medsurg and lastly a more specialised division, NeuroTech and Spine. A JP Morgan medical conference presentation from their investor relations website breaks it down perfectly, a picture tells you everything you need to know:

The future looks exceptionally good for a business of this nature. Technology advances are going to work exceptionally well alongside a business of this nature. The company talks of advancing 3D printing of knees, revision cones as well as newer spine therapies. A quick browse through the orthopaedics product catalogue on the website -> Stryker Orthopaedics, gives you a good reminder that the future is here already.

The growth will continue to be via specialty acquisitions, the integration of Mako surgical is now complete (deal done in December 2013), don't confuse this with another purchase of Muka Metal, a maker of specialised hospital beds in Turkey. The company announced a newer purchase at the beginning of the week, they are buying a privately held business called Sage for 2.775 billion Dollars. As per the presentation, Sage "develops, manufactures and distributes disposable products targeted at reducing "Never Events," primarily in the ICU and MedSurg hospital unit setting".

"Never events" is a relatively new term, introduced by a MD by the name of Ken Kizer, it refers to procedures on the wrong body part, or on the wrong patient even. Here the NHS lists their definitions and guidelines for Never Events. It is a pretty smart acquisition all round and complimentary business, that adds just over 4 percent to total sales.

And almost all of the Sage business is inside of the US, only 5 percent outside, which means that there is more room for growth. These products are all designed to significantly reduce hospital acquired conditions, as well as improve the healthcare workers safety. Plus Sage is currently number one in a 1.8 billion Dollar market. As Stryker point out, 30 billion Dollars is spent annually in the US to treat the conditions that Sage can prevent, there are hospitals, patients, healthcare workers and medical insurance companies all on the same page here as far as priorities are concerned.

Growth will also come via pushing the business internationally, the sales split last year was 71 percent US and the rest being international sales. There is strong sales momentum in Europe, that recovery story should continue. Whilst this may not seem like the most exciting business at face value, their products are pushing medical science boundaries to improve the lives of many. And whilst society ages and is in desperate need for new knees, hips, as well as careful spinal products, it also improves the quality of life of all of us. To give someone the gift of less pain is worth more than the money shelled out, relative of course. As the world gets richer, so more of these products and procedures will become everyday and commonplace.

Whilst I don't see a runaway share price from here, I do think that this is one of the best business in this space globally, from the research that we have done at Vestact. We remain conviction buy, most especially if the stock sags from here. Remain patient (excuse the pun), lie in waiting, this company will certainly reward you in the long run.