Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont fell short in a sales update that may have been somewhat shy of expectations, for the first time however it was evident that the terrorist attacks in Paris has been a part of the softer sales. The attacks of course were just over two months ago, 13 November. Those attacks certainly shook all and sundry, Paris is of course one of the most visited cities in the world. If I am not mistaken, from my reading, the Notre Dame de Paris is the most visited free place in the world, you don't have to pay to get into a church. That church took nearly 100 years to build, "things" were a little slow back then.

I read a WSJ article (Burberry, Richemont Sales Cool in Hong Kong, Paris) that suggested that various trips to Paris were cancelled, in particular from China, where the luxury goods trade has been welcome for the likes of Richemont and their peers. Ticket sales, airline tickets from China that is, dropped 54 percent. And with regards to visits to Hong Kong by luxury goods tourists, the same article points out more stringent visa requirements to visit Hong Kong. Imagine wanting to go to Cape Town, or Durban and needing a Visa?

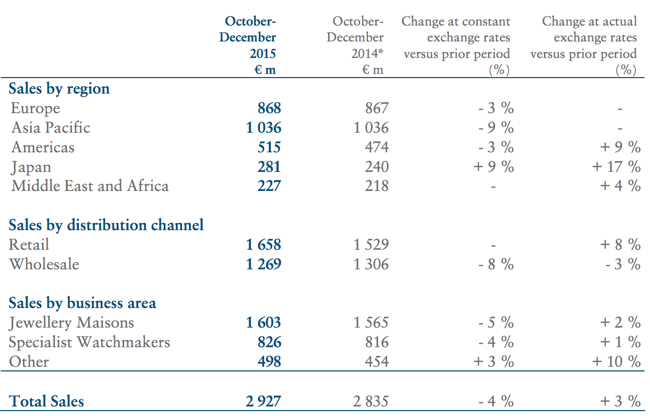

Anyhow, here is the trading update: Trading update for the third quarter ended 31 December 2015. Here is the table that is relevant:

The company points out that "the slowdown in sales largely reflected weak trading in Europe" and suggests that this "began in November and primarily reflects lower levels of tourism in the region." So the WSJ additional research corroborates this. As for the outlook, the company says "The challenging trading environment is likely to prevail in the final quarter to 31 March 2016."

So it is tough out there. I still maintain that this is one of the best that you can own here in South Africa. Currency issues aside, the company owns brands that are unique and almost irreplaceable. You cannot replicate hundreds of years of history and unique workmanship, brand value and prestige even in a single generation, with regards to the goodS they sell. Of course you need the customers, the shift to more consumer related activity in China should continue to be really helpful for the company. A lower share price in what is likely to be a lower year for profits will mean opportunities, we continue to accumulate on weakness. Be patient on this one. The stock sank over two percent on the day.