Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

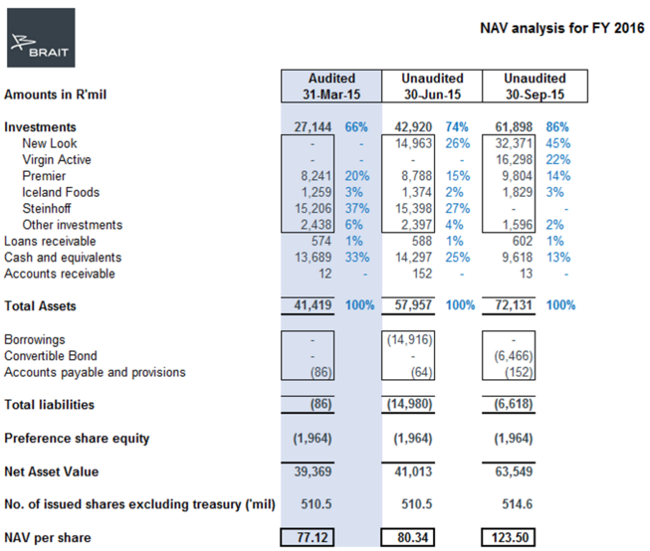

Brait released their results last week, this was for their six months to end September. Byron went to the presentation, he was pretty impressed, the company brought all their company heads in an epic company presentation. The investment company has been exceptionally busy over the last year to year and a half, this period was especially busy. Having sold the Steinhoff shares, and other investments, having raised a lot of money in a convertible bond issuance, the company has proceeded to add to their Icelandic Food business, as well as bed down some of their recent big transactions. For a quick look at how many moving parts there have been over that time, here is a snapshot of their NAV analysis for 2016, as at the end of the six month period:

You can see that quite simply, in descending order their most important assets are clothing group New Look (45 percent of NAV), health business Virgin Active (they own 78 percent) and this represents 22 percent of the overall NAV, and then their almost all of Premier Foods (management own the rest) equates to 14 percent. The rest of the NAV is made up of Icelandic Foods, 3 percent, and then cash and cash equivalents at 13 percent. The company can only report the values of these businesses when comparing them to their market peer grouping. This is not so simple, as Virgin Active has no real peer in their space.

Their biggest asset, UK based New Look however does have a peer grouping, comparable to H&M (stupid queues at lines at the recently opened Sandton store I am told), Inditex (you would know them as Zara, their flagship brand), as well as the likes of Marks & Spencers and Next. Locally the company is comparable to Mr. Price. As we mentioned, it is not easy to find a peer grouping for Virgin Active, the company is at pains to point this out. Either way, they discount both New Look and Virgin Active to their peer grouping , applying a ten percent discount to New Look and 20 percent to Virgin Active, even more on the spot prices of the listed entities, 13 to 24 percent respectively. Which may explain why the shareholders are willing to apply a premium to the reported NAV, as that is at a discount. Isn't this just the market being efficient and closing the gap?

So why would you want to own this company? The management has shown that they can certainly sniff out the best deals at the right price, sweat those for a period of time and either on-sell them or grow them into larger entities. The recent convertible bond issuance also shows a certain maturity, they have become the first company (to their knowledge) who are able to raise money in this fashion without a main listing in Europe. We recommend again that clients own this stock as a core holding, there are certainly some crossovers with Tiger and Premier, Woolies and New Look, the Virgin Active is exciting and has very little comparable, you could argue that the Discovery Vitality (and white labelling of the product) is comparable. A great business, well run, and whilst it seems like a significant premium to pay, we are comfortable based on the discounted value applied by management.