Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The Mediclinic circular has been posted and if you are a shareholder of the stock you will have the opportunity to vote, the Mediclinic shareholders will vote mid December. I hope that you are all still around. The Al Noor shareholders will also vote on this, the NMC Health deal disappeared on Monday, they announced that they would not be pursuing the purchase of their Emirates rival. The Al Noor information does not appear (as we write) on their website yet, I will continue to monitor. Let us presume that all the shareholders on both sides vote yes (they probably will), the new Al Noor shares (that you will own in the ratio of 0.625 per Mediclinic share you currently own) will be listed on the 1st of February, next year. The business will then change its name to Mediclinic International PLC, and will have the main board listing in London, an inward secondary listing here in Jozi.

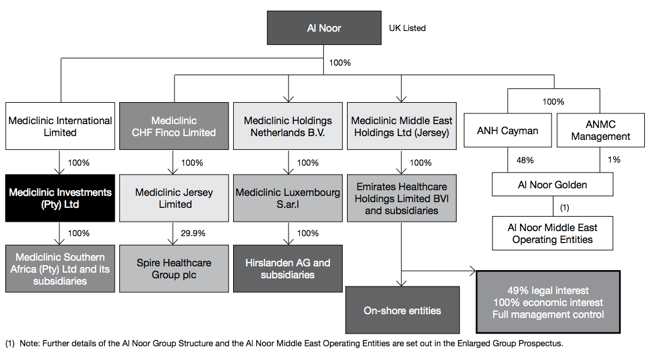

You can download the Scheme Circular from the Mediclinic Investor Relations page, it is 300 pages plus of legal work, investment banking work, company IR work, there are tons of contributors there. RMB and Morgan Stanley for their work on the scheme get 167 million Rand apiece, good work if you can get it. Slaughter and May in the UK get 85 million Rand, the whole scheme will cost 468 million Rand. I would say that it is at the end of the day, well worth it in the long run, if not balking at the price in the very short run. That is your money shareholders. This is an organogram of how the combined entity will look like:

I see Jersey, the Netherlands and the Cayman popping up there, all favourable tax destinations. I guess in this modern world, this is how businesses are structured. The question that private client shareholders are likely to ask is, what must I do with 300 pages of reading material? Nothing, if you are our client, we will elect on your behalf, the shares in the combined entity. Remembering that directors and more importantly, Remgro as the anchor shareholder (over 43 percent) have given irrevocable undertakings to vote in favour of the scheme. The shareholders currently are as follows:

We will watch and continue to advise on the transaction as it unfolds over the course of the next two and a half months, all the way into Valentines Day, when it is expected to be concluded. More or less then. Mediclinic, the combined entity will have access to global capital markets, they will then have access to cheaper funding in order to build what will no doubt be a bigger entity in a fragmented healthcare market. We continue to recommend the stock as a buy.