Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Mediclinic have released their half year results to end September this morning. Revenue up 16 percent to 19.5 billion Rand, normalised EBIDTA up 16 percent, margins stable at nearly 20 percent. Adjusted basic normalised HEPS up 19 percent to 214.1 cents, the interim dividend was 16 percent higher to 36 cents, hardly a kings ransom, the company has been growing aggressively and has just asked their shareholders to shell out serious money in order to acquire a 29.9 percent stake in Spire Healthcare (10 billion Rand rights issue), the dividend is going to be not the reason you own this stock currently.

Once they have bedded down some bigger transactions, I do not think that they are near finished, even after completing the pending Al Noor transaction, see Mediclinic and Al Noor to tie up, they may first be in a position to service debt aggressively and then become a bigger dividend payer. That deal (to buy Al Noor) is still set to be approved by both sets of shareholders, I suspect it will go through.

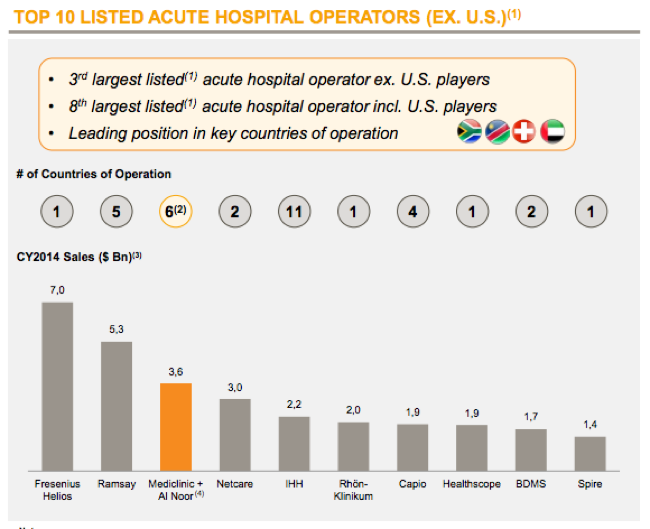

In the analyst presentation, there are two slides that sum up how the transaction with Al Noor is likely to proceed. Al Noor shareholders are likely to get 11.6 Pounds per share, which consists of a 3.28 Pound per share special dividend. What you will get as a Mediclinic investor is 0.625 Al Noor shares (in London), the company will then rename to Mediclinic International, primary listing in London, secondary listing here in Jozi. Mediclinic existing shareholders are likely to own between 84-93 percent of the combined entity, depending on how many of the existing Al Noor shareholders take cash. Outside of the United States this combined entity by sales will be much bigger than you think, true story, see one of the images from the presentation:

The deal is expected to close early 2016, according to the presentation.

Currently the revenue split is 34.55 percent South Africa, 52.7 percent Switzerland and the balance, 12.76 percent the United Arab Emirates. Of course with the 30 odd percent of Spire and the pending purchase of Al Noor, that could all swing quite sharply, being a heavier weighting towards the UAE, more importantly getting a foothold in private healthcare in the UK will add another territory. In terms of operating profits, Switzerland contributes 43.3 percent, South Africa 41.6 percent and the Emirates the balance, both South Africa and the UAE are obviously more profitable for the group. More costs in Switzerland with the smaller operations and higher cost of doing business, obviously, that territory has one of the highest standards of living in the world.

The CEO Danie Meintjes sums it up perfectly in the SENS release, ahead of the presentation at 10am this morning: "The Group continues to deliver against its key performance indicators with high levels of cash generation, growth in patient activity, stable margins and effective cost control. This is against a market backdrop of increasing demand for our services providing geographic expansion opportunities. With both a strengthened balance sheet via a successful rights issue, and capital investments made during the period, Mediclinic remains well positioned for future growth."

With Remgro as their anchor shareholder (they have even applied ), Mediclinic will continue to grow their business. They will continue to look for opportunities as and when they present themselves, as well as grow their existing businesses. Expanded healthcare is an important investment theme globally, we continue to feel that Mediclinic ticks all the boxes. We will review the results along with the presentation, and deliver exactly the same conclusion, we continue to accumulate Mediclinic.