Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

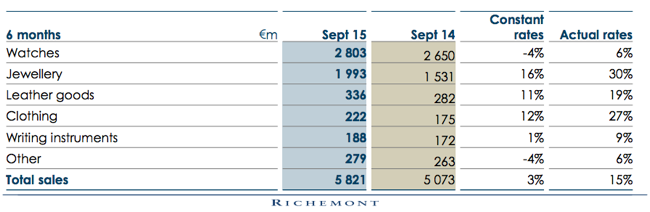

Richemont have released six month results to end September, sales up 15 percent in Euro terms, 3 percent increase at constant exchange rates to 5.821 billion Euros. Such is the weakness of the Euro relative to their selling territories. Gross profits increased 13 percent to 3.786 billion Euros. Operating margins were described by the company as robust, they did sink 200 basis points to 24 percent. Yet, after all of that, profits managed to increase 22 percent a share, equally earnings per share increased by 22 percent to 1.949 Euros.

Now this is the part where you must be careful, whilst the company reports in Euros, the stock is primarily listed in Zurich, and the global depositary receipt that we own down here is one-tenth of a share in Zurich. So essentially divide the Euro earnings by ten and then apply the exchange rate to work back to Rand terms. 19.49 Euro cents equals 2.95 Rand. The stock remember has been reaching and touching new all time Rand highs, last evening the close was over 120 Rand.

As per the presentation of the half year results, strong performances in the old world, Japan and Europe more than offset what is still negative conditions for luxury in Hong Kong and Macau. The latter are destinations for luxury shoppers from mainland China. Jewellery in particular looked good, showing a 16 percent increase in sales at constant rates, 30 percent in actual rates, see table below. What is interesting is that Asia Pacific and Europe in terms of percentage sales are nearly back on an even keel, the weaker Euro has meant stronger tourism and more buying of luxury goods in that part of the world. Mainland China has interestingly showed signs of improvement, we did see that in the five month trading statement.

Everything looks OK, until you get to the point where October sales are reported in these results, and that is the reason for the weakness in the share price this morning, constant currency sales looking weak. We continue to accumulate what is a world class collection of luxury brands, centuries old and only more valuable as time goes on, the quality is undisputed.