Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

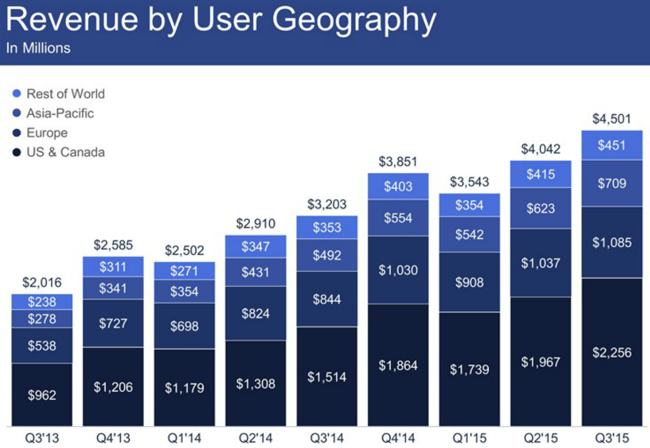

Facebook reported numbers post the market close last evening, this was for their third quarter to end September. Highlights include crossing the billion daily active user mark for the first time ever, a 17 percent increase over this time last year, of which 894 million are on their mobile phones (27 percent increase year-over-year), monthly active users are 1.545 billion (1.385 billion on their mobiles, 1 billion on Android phones). And you and I can remember a time when the chattering classes were worried about Facebook being able to monetise mobile, remember that and the "disastrous listing"? Quarterly revenues grew to 4.5 billion Dollars, a record quarter for the company, the lions share of that (4.299 billion Dollars) being advertising. Revenues across all of their geographies grew strongly, when measured against the comparative quarter, take a look at this slide from their presentation:

Having said that though, 73 percent of their revenues still come from the developed world, the US & Canada, and Europe. Potential exists across their other geographies, including Europe, where the average revenues per user (ARPUs) is one-third of that of the US. See slide number 12 of the Facebook Q3 2015 Earnings conference call and slides. Across the rest of the world ARPUs are less than one-tenth of the US. Much scope to grow still.

As well as being a record revenue quarter, it was equally a record income quarter. Non-GAAP operating income registered 2.41 billion Dollars, net income was 1.628 billion Dollars, operating margins were steady at 54 percent. Non-GAAP diluted earnings per share clocked 57 cents, again, a quarterly record. And all these quarterly records ahead of what is their best quarter, the final one in the lead into the festive season. The company continues to spend heavily, in the last quarter the company invested 780 million Dollars, compared to 1.36 billion for the whole of 2013 and 1.83 billion in 2014. In other words, what I am trying to show is that they are spending more and more on their infrastructure. And they need to keep improving their infrastructure, the number of daily video views since 6 months ago has doubled to 8 billion. That is pretty heavy, and the shift to video has been quicker than I thought it would be.

Some other interesting factoids from the Earnings Call Transcript, from Mark Zuckerberg. WhatsApp reached 900 million users, The Zuck suggested of course that it is a matter of time before they reach one billion on that platform too. Messenger, their other app has now 700 million active monthly users, 9.5 billion photos are shared monthly over that platform. Instagram, the other major platform has 400 million users and around 80 million photos are shared a day. I love Instagram, what an amazing platform.

Oculus makes progress too, the full version will be shipped next year (the Rift), the Gear VR (VR stands for virtual reality), which is a partnership mobile product with Samsung is set to be released this holiday season. Here it is, if you want to check it out: Gear VR. As the CFO said on the conference call however: "But VR is still very much in the development stage. So it would be early to be talking about large shipment volumes." Early days for virtual reality. Of course the options are endless, watching sports matches, going to the theatre, amongst many other entertaining activities.

Their platforms account for one in five minutes spent on mobile phones in the US, that means there is still scope for growth. And what is amazing is that there are only 2.5 million active advertisers on Facebook, whilst 45 million small to medium businesses have pages. Those people may start advertising a little more aggressively, once they are comfortable with spending the money in order to grow their businesses on an alternative platform. I think that there will definitely be a marked shift, younger generations are more receptive to newer platforms.

Earnings for this year are expected to be in the range of 2.10 to 2.20, and then with expectations of a 30 percent lift next year, will be in the range of 2.70 to 2.80. Remember that they IPO'ed at 38 Dollars a share back in May 2012. If you had said back then, that you could buy the shares at the IPO on 2016 earnings multiple of a mere 14 times. Yet back then, the company was overvalued, and when they could not monetise mobile (that was the perception), the share price fell to 18 Dollars three years ago. Last evening the stock traded in the aftermarket at nearly 108 Dollars. We continue to recommend the company as a buy.