Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

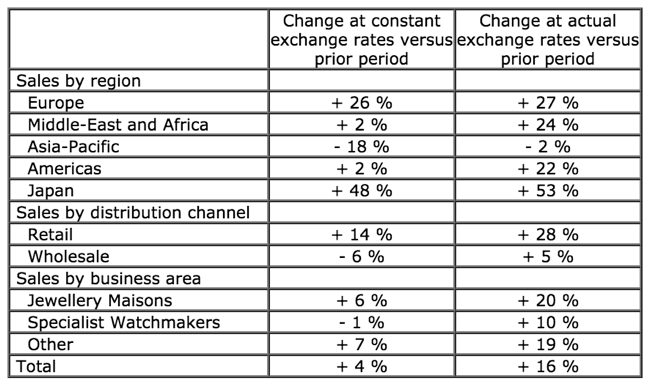

Richemont have released a five month trading update this morning. Whilst the currency swings were negative on the way down (for the Euro), they have been equally positive on the way up. At real exchange rates sales only increased 4 percent, in reported currency (Euros) sales increased 16 percent. Europe itself has made a massive comeback, confirming once again that the European recovery has been in full swing here.

Plus, as the release points out, sales were further helped thanks to good tourist numbers (the weaker Euro made it more attractive) in Europe. Equally Japan had a big contribution, that was however as a result of once off factors last year where the sales tax made people buy loads of luxury goods in the first half of the year. The huge blot and confirmation of a slowdown in China is an 18 percent slump in Asia Pacific Sales (minus two percent in Euros). Here goes the table:

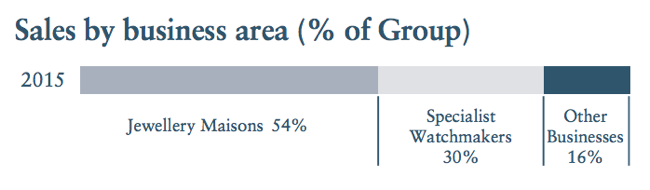

If you need to know the contribution from each segment, look no further than the last annual report.

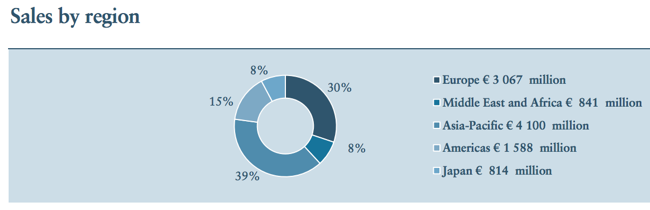

And then of course, sales by region for the full year, as per the annual report:

So what is telling here is two things, one their watch sales is their second biggest division and sales were flat in constant currencies, whilst people went gaga for jewellery (their biggest division) and their "other" segment. Peter Millar, Lancel, (perhaps even Purdey), Shanghai Tang, Chloe, Alfred Dunhill, Alaia and Mont Blanc. Clothing, bags, accessories and even shotguns? Fragrances, wallets, purses, the lot. The other notable thing is that whilst Asia Pacific got spanked, it was Macau and Hong Kong, regions of opulence in China. The release says: "Mainland China resumed growth with retail sales growing at a strong double-digit rate, overcoming lower wholesale demand". As one of our readers pointed out with tongue in cheek,"Must be because China is going backwards???". Well said, on the ground companies are still reporting strong numbers out of China.

So China is regional if you needed reminding, and the story is intact for mainland China to continue to be a bigger contributor in time. We need to wait until the 6th of November to see the first half of what has been a wild currency ride and concerns about China. Although that seems to be confined to the areas of opulence (they be having it as per the DirectTV adverts), which is important. I am not too sure what markets are going to think of these numbers, their costs in Swiss Francs may have risen with the Euro depeg, so their profits might not reflect that really good sales number, albeit in Euros. Still, pleasing to see a major comeback from their second biggest market in Europe.