Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

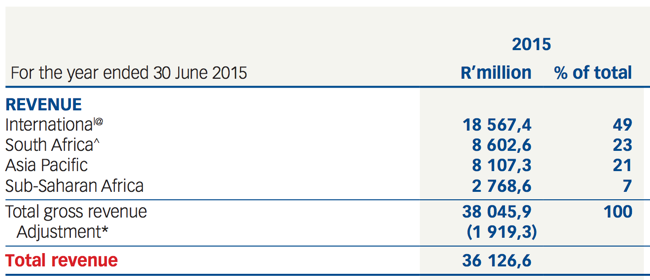

Aspen released results for their full year to end June 2015. This is a company that operates in 70 countries across the world and distributes their products across 150 countries. Wow. They have divested 800 million Dollars in a number of transactions, equally they have done three large transactions in the same year, not ideal to do them all in the same year said the CEO Stephen Saad. Revenue grew 22 percent to 36.1 billion Rand, operating profits increased by 14 percent to 8.4 billion Rand. Of that, South Africa is now around one quarter of revenue (23 percent to be exact, 21 percent of profits), as Stephen Saad says, it will always be their home. See segmented revenues below per region:

Normalised headline earnings per share was 15 percent higher at 1219 ZAR cents, headline earnings adjusted for specific non trading items (their accounting words, not mine) was 5.6 billion Rand. Net debt in Rands increased to 30 billion Rand, 2.5 billion as a result of "unfavourable" exchange rate movements. Net foreign exchange losses were 479 million Rand, no thanks at all to the strong Dollar against the Euro, the Aussie Dollar and the Rand. Imported chemicals (to manufacture) impacted heavily by a strong Dollar. The group will do a capital distribution of 216 cents (hardly a kings ransom), payable 12 October this year. And I think most importantly, at least in the short term, the cautionary had been withdrawn: "negotiations have not progressed to a satisfactory conclusion." That was around an infant formula business in China, sigh, that was a big one that got away.

Aspen actually has quite a large business in Venezuela, true story and as a result of the hyper inflationary environment in that crazy country, revenues were up 143 percent in Rand terms. There are actually different account rules when dealing with the Venezuelan economy, as the company describes in their results release: "The Venezuelan economy is regarded as a hyperinflationary economy in terms of International Financial Reporting Standards. There are three regulated exchange rates which are applicable in Venezuela"

How can you have three different currencies? I recall that in the dark days of the Republic here, we had two different exchange rates, not so? Nuts, the sooner the bus driver drives himself off into the sunset, the better for all Venezuelans bent on following revolutionary Marxist economic "policies" that lead to total destruction. I guess they are closer to losing now than ever before with the oil price having fallen in a heap.

There is almost always a lot going on with this company, I suspect in the next couple of years that they will work hard on their existing businesses and use the springboard as an opportunity to expand into higher margin therapies. Something that Stephen Saad said in a radio interview takes 4 to 5 years to roll out. He also suggested in a CNBC Africa interview that Aspen was in a better position to acquire than any other time before. Small in global pharma terms, which means that there is still many opportunities. They are very focused in optimising their business, sweating the current assets and improving margins. As he also said, you cannot make any mistakes when producing their products, they are going into peoples bloodstreams.

Whilst the currency issues impacted negatively twice, with the imported products and secondly with their trading geographies, Stephen Saad suggested that perhaps they need Dollar based revenues. Although at the same time, the US market is hard and tough, lots of legislation and not something Aspen haven't explored, they just have not found the right business. Whilst the market saw these results as disappointing, I suspect that the currency translation will work its way out of the system over the next twelve months. This is a fabulous business with one of the best dealmakers and managers in the country, whilst the price has definitely disappointed as of late, the longer term opportunities that remain make this company a solid part of each and every portfolio. We maintain our buy recommendation on the stock. We will continue to monitor the news flow over the coming days.