Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

According to their website "Brait is an investment holding company focused on driving sustainable long-term growth and value creation in its investment portfolio of sizeable unlisted businesses operating in the broad consumer sector."

Normally Vestact has avoided investment holding type businesses because we feel we can construct a portfolio of listed businesses which will outperform the underlying portfolios of said companies. Especially when many of their holdings are stakes in listed buildings which we have access to.

Brait however is slightly different. They buy controlling stakes in unlisted businesses. In today's environment with low interest rates the market trades at a premium, especially the quality stocks which are showing good growth. Sometimes the best opportunities are not listed. This is what Warren Buffett has done so successfully over the years.

When you analyse an Investment holding business there are two obvious things you need to consider, the underlying assets and the management team. Let's look at the assets first.

The company has been very busy of late. Sasha covered the Steinhoff buying Pepkor deal here so I am not going to delve into those details. All you need to know is that they bought a stake in Pepkor in 2011 which they valued at R4.1bn. They sold it at the end of last year for R15bn in cash and 200 million Steinhoff shares (valued at R11.4bn back then, now worth R15.72bn). So lets just say it was a good deal. They are planning on selling that Steinhoff stake because minority stakes in listed businesses is not their game. Expect more action soon.

The company has four core assets at this stage, two of them are recent acquisitions following the Steinhoff deal. The image below which I took from their website lays it out.

New Look. Because we are a team here I am going to copy and paste Michael's coverage of the deal which pretty much covers everything I needed to say. "Brait are back in the headlines with another massive deal. They will pay GBP 780 million for a 90% stake, which they are buying from two private equity groups, the remaining 10% is held by management (great for incentives and aligning interests). At this mornings exchange rate that works out to R 14.55 billion.

The market cap of New Look will be GBP 867 million and add to that GBP 1 billion in debt, which gives you an Enterprise value of GBP 1.9 billion. What do the earnings look like? At the end of 2014 they had EBITDA of GBP 211 million, which has been growing by double digits. They are then paying 9 times EV/EBITDA, which is fair given the high growth projections and the low interest rate environment."

From what I have read, New Look is similar to Mr Price but it targets mostly Women. They have over 800 store in 21 countries, 33 in China and 569 in the UK. According to Mr Price's latest results they have a market cap/EBITDA ratio of 18.2 (they have no debt). It looks like Brait got a good price. Apparently the team have been eyeing this one out for nearly a decade.

Virgin. Brait bought an 80% stake in Virgin Active in April of this year. The deal cost them 682 million Pounds, R12.2bn at the time. Virgin Active has 267 health clubs in 9 countries around the world. South Africa is their stronghold but they also have solid exposure in the UK, Italy, Spain and Australia. If you know our stance on health and wellness as an investment theme you will know that we fully endorse this deal. Virgin also have a very lucrative tie up with Discovery's Vitality whereby Vitality pay half the joint clients premiums. Its a great business model. The gym I go to gets fuller and fuller every year, especially just before summer. People want to be fit and healthy. Personal trainers have to pay up to R12 000 a month just to rent the facility. I feel this will grow globally, especially in the UK where Vitality is present.

Premier Foods. This food and consumer goods manufacturing business has some quality brands like Snowflake, Blue Ribbon bread, Lil-lets, Manhattan and Super C. Operating a consumer driven business in South Africa with a quality brand portfolio has great potential both locally and abroad.

Iceland. Iceland is a food retailer in the UK with 850 stores around the country. It has 15.9% of the countries frozen food market share even though only 36% of their goods sold are actually frozen foods. The UK economy is doing well and so is the Pound to the Rand. Another sound investment.

Management Team. The CEO is John Gnodde. A few years back Gnodde and his team decided to change the structure of Brait from a private equity company to an investment holding company. Although many weren't happy with the way they structured a deal to make the executive team and directors of the company the biggest shareholders (32.4% combined), at least your interests are aligned with those making the big calls. The share price has gone from R18.50 in March 2011 when Gnodde took over to R140 today. Gnodde was also the Master Mind behind the Pepkor deal which turned out to be a fantastic call. Christo Wiese is another name that needs no introduction. He sits on the board and is a big shareholder. Everything he touches seems to turn to gold and I am sure his deal making and retail experience will filter nicely down to the executive team.

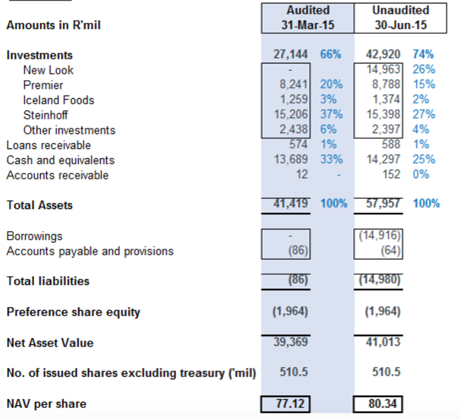

Valuations. Have we already missed the boat on this one? The company released an NAV update on the 5th of August. See below

As you can see, the NAV per share according to management is R80.34, well below the R140 share price. Management are inherently very conservative with their valuations. In fact one month before they sold Pepkor for R26.4bn they valued it at R11.5bn.

To answer the question above, no you have not missed the boat. We feel the boat is still in the harbour, loading up on fantastic assets and we are ready to jump on board. What you are buying into here is a fantastic team of asset selectors who have just done some great acquisitions with more to come when they liquidate the Steinhoff stake. We recommend a buy on Brait.