Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Woolworths have released results for the 52 weeks to end June, remembering that these numbers include 11 months of David Jones. Total revenue of 58 billion Rands is an increase of 45.4 percent on last year, including concession sales revenues grew by 54.9 percent (excluding David Jones it is 12 percent). Adjusted profit before tax grew 20.5 percent. The food business was the great standout, total sales there were up 13.5 percent with the supermarket model working well.

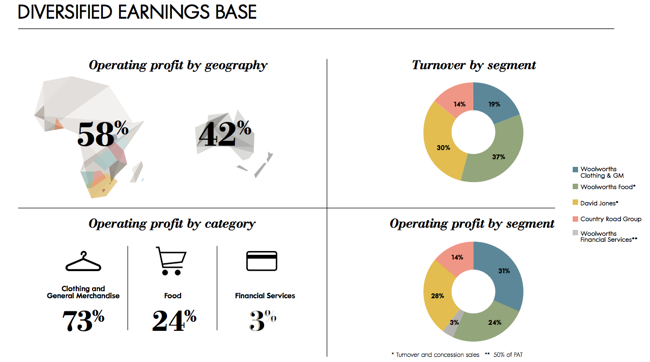

In the slide presentation to analysts (slide 8) the company says that food sales "Growth ahead of the market every month since September 2011". 4 years of solid outperformance, and as both you and I know, the consumer does not generally lie. Ever. This next chart is important for seeing where the profit and sales mix comes from:

The light brown is David Jones. That segment (David Jones) had a strong second half, sales up 10.7 percent (H2) in a weakish Australian consumer market. Inside of this period will be the deterioration of the Aussie Dollar (like the South African Rand, "commodity currencies" globally have been negatively impacted) and more importantly, the dilution by way of the rights issue done last year, when the company turned to their shareholders for 10 billion Rand. Remember that rights issue was done at 59.5 Rand a share, the stock closed last evening at 98.89 Rand. It was a good idea to follow your rights.

This is a big business, with a market cap close to 103 billion Rand, 1.04 billion shares in issue, it is always going to be pretty easy to work out! 167.8 million shares were issued in the rights process done last year. The dividend cover remains at a very handsome 1.4 times (invert it to get the dividend payout ratio), that has increased a little to 247 cents for the full year. Diluted headline earnings per share clocked 367.1 cents, the stock looks pricey at 27 times. We will get to that in a second.

The outlook is neither completely muted or tearaway: "We believe that economic conditions in South Africa & Australia will remain constrained, especially in the lower and middle-income segments of the market. The upper-income segments in which we operate continue to show some resilience. Trading for the first eight weeks of the new financial year has been positive. The transformation and integration of David Jones is progressing ahead of expectations."

OK, so as I said, the stock is pricey. In part the dilutionary impact of more shares in issue. I do know one thing however, this is a really good business with a really sharp management team. They are not aiming to be the biggest in size or the cheapest. They are however the best of the quality, you get what you pay for in life. As a consumer of all the major retailers in South Africa, I am very mindful that Woolworths are certainly not the cheapest, they are however the best quality, in my opinion. And you always get what you pay for. As with a company that is likely to grow their earnings in the mid teens for the next couple of years, we continue to be happy to pay up for the quality of the business, a strong dividend policy too, we continue to rate Woolworths shares as a buy.