Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The most important "thing" to come out of the BHP Billiton results yesterday was their downgrading of peak Chinese steel production. Which is very important for their iron ore and metallurgical coal business. Of course this is very important for all iron ore producers globally. BHP reckons that, from their presentation: "we expect China's crude steel production to peak between 935-985 Mt in the mid 2020s". The previous guidance was at the high point 1100 Mt.

What has changed a lot in the BHP iron ore business is their costs, production costs have been driven down to 17 Dollars per ton, an astonishing figure. To think that it didn't matter when the elevated iron ore price meant that cost cutting initiatives were something to happen later. Cost cutting had a massive positive impact of 3.8 billion Dollars, a negative impact of 15.2 billion Dollars as a result of much lower commodity prices. That is the biggest problem, this is possibly the finest in quality of all the mining companies, yet, like everyone else, they cannot control the prices. And whilst the quality will remain, the focus will be on long term shareholder returns, the market remains oversupplied in some very key commodities. Oil and iron ore. The demand side looks lukewarm, another big infrastructural program from perhaps India needs to emerge for prices to get a serious lift.

The dividend was increased marginally, earnings were crushed as revenues fell nearly one quarter. We continue to lighten our commodity exposure across the board and have been doing so for some time now. No matter how good the management team, no matter how good the cost control, the price is controlled by the market. Which is not really fair, the price for all products is essentially set by the market. However, as we know, a longer dated bet on higher commodity consumption (which is expected as we continue to urbanise) is somewhat a bet against human innovation.

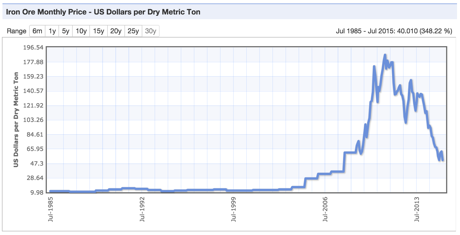

As production costs decrease as a result of innovation, the marginal miners will be flushed, it will be ugly and in the end the quality majors will prevail, BHP will still be top of the pile. The cycle may be very deep from peak to trough, and as people who were in commodity markets for thirty years will tell you, for the first twenty years basically nothing happened. I shall leave you with a 30 year graph from IndexMundi of the Iron Ore price, for you to see what I mean. Literally nothing happened for 20 years.

That is right, I recall a headline that I once posted which said something along the lines (when referring to rent resources tax globally on commodity companies being mooted by "smart" governments) "You did not make that iron ore price". Exactly, the market made the price.