Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

It's getting hot in there, so take off all the prose. In this case it was the other way around, the chaps from Curro stuck out a stinging SENS in response to the Advtech board rejecting their offer. This is unusual that any PSG controlled company goes hostile, it seems now that Curro will speak to the shareholders of the company. After all, they are the owners of the company and had expressed a desire for a deal of some sort to happen, bearing in mind that it is at a significant premium. We had seen earlier in the day a letter to parents of a school that is owned by Advtech, suggesting that any bid would be disruptive for the teachers and pupils. Not a single mention of the shareholders, the people that actually parted with their funds in order to build these institutions.

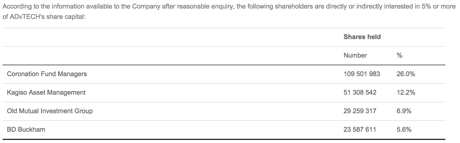

First things first, who are the shareholders of Advtech? As per their website, under the segment Major shareholders, they are:

Coronation, Kagiso, Old Mutual (who have done deals with Curro before, that is not unusual for Old Mutual though) and BD Buckham. Who is BD Buckham? He used to be a non exec, Brian Buckham, who last transacted in shares in November 2006. He sold a few, correction, he sold nearly 900 thousand shares. He is actually the founder of the business, from way back in 1978. At 76 years old, I wonder if he is up for the fight, or maybe he can cash in at this level. His stake at the closing price is worth 287.7 million Rand. Motty Sacks used to be a non exec there too.

As is the case with many mid cap listed businesses, there are very few shareholders that Curro will have to talk to. There is a total of 83 shareholders that hold 75.4 percent of the shares, we have identified three shareholders who control 45 percent of the business, together with the founder, just over 50 percent. Remembering that Curro need not get it all, they are offering smaller shareholders cash.

Before we move away from shareholders, there is one board member, temporary CEO, Frank Thompson who has much to gain here. I think that is worth noting. As at his retirement date last year, in October, he owned 12.367 million shares. At 12.2 Rand, where the price closed last evening, he is worth 150 million Rand on paper. Not bad for a 30 year plus career in corporate South Africa. He ran Advtech from the beginning of August 2002 to October 24 last year. Leslie Massdorp (who had 2 million options at 8.19 Rand, as per the annual report) came to replace Thompson and left immediately on the 23rd of March. I am guessing that if anyone knows the business well and better than anybody else, it must be Frank. As part of the board and person who owns 2.9 percent of the business, he has said no thanks to Curro. I certainly think that is worth noting.

Yes, so here goes, as per the SENS announcement from Curro, they had written letters of support for a deal price of 13 Rand from "major Advtech shareholders". This was at a 42 percent premium to the 30 day "volume weighted average price of Advtech at 28 April 2015, the date prior to the submission of Curro's initial expression of interest to Advtech."

Curro had made a proposed offer at 13 Rand: "The proposed offer by Curro is based on a share swap with Curro valued at R33.65 per share, resulting in a swap ratio of approximately 2.59 Advtech shares for every 1 Curro share. The proposed offer also includes a 50% cash underpin for Advtech shareholders who do not wish to accept Curro shares (a minority shareholder is likely to be able to receive 100% cash, as many of the major shareholders have indicated preference for Curro shares). The aforesaid offer was only subject to a limited due diligence on specific matters;"

Possibly the best point that Curro made in their SENS announcement is a point that Byron made on PowerFM last evening (what you mean you never heard him?) and it is simple. When Advtech announced that they had bought Maravest, they were happy that issuing shares of their own at 8.02 Rand a share and that was a fair price. The Advtech board believed this to be a fair reflection of the value of the business, and said as much. So why would 13 Rand a share not reflect (it is after all a 63 percent premium to that) a really magnificent price, more than fair? That is why I think Curro are more than peeved, you can't suggest it does not reflect the real value of the business, when you said something much lower was fair. Even if the market might have thought that Advtech overpaid for their recent transactions, perhaps Curro are talking to those shareholders, they would have made some quick bucks out of all of this, not so?

I suspect that this is not over by a long stretch, it is pleasing to see private education making so much headway in South Africa, filling a vital gap in the economy where parents see the benefits of a wonderful education for their children. Far better than they had or their parents could afford, education is something that everyone should be passionate about. It is of course a very emotive issue globally.