Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

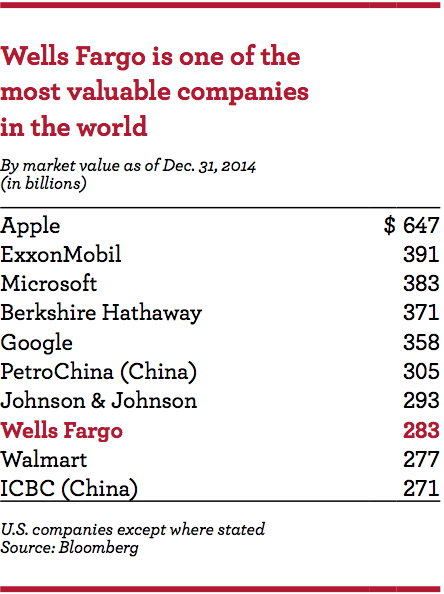

Last week we had the second quarter results from Wells Fargo, who you will probably know as one of Buffett's "Big Four stocks". Berkshire Hathaway owns nearly 10% of the company which currently has a market cap of $299 billion. Here is where it ranked in size at the end of last year:

Here are the numbers that count: EPS up 2% YoY; Revenue is up 1% to $21.3 billion for the quarter; loans up 1% to $870 billion; dividend is up 7% and they repurchased 36.3 million shares. Net interest margin dropped to 2.97% from 3.15% a year earlier. Net Interest margin is the main number to look at when it comes to banks. It is the difference between the interest that they have to pay out to their depositors and the interest that they receive on lending out money. So the bigger the Net Interest margin, the more profitable the company. Given the low interest rate environment, the Net Interest Margin has been pushed lower as their longer term interest received on loans has been substituted by lower interest rates.

What impact does a FED increase of interest rates have on Wells Fargo? My first reaction would be a slightly more negative impact, due to customers having to pay higher interest, they would demand less of the product (loans). It is defiantly a blurry cause and effect in the case of many banks but after doing much reading on the topic I think Wells Fargo will benefit for interest rate hikes. Here's why:

1) Interest rates going up means that the economy is stronger meaning that there are less bad debts but also that corporate America becomes a bigger customer.

2) Currently 26% of deposits with Wells Fargo is non-interest generating, which means that when rates go up they can take those deposits and lend them out at a higher rate and still not have to pay for them. This will have a nice boost on their Net Interest margin.

Banks are considered a good proxy for the economy in general because the better things are going in the economy the more people spend and the more people borrow. This is a company that we would buy given that the long term outlook for the US is bright and that interest rates are going to start rising soon. The added bonus is that the major shareholder is Buffett who likes a more 'boring' approach to banking and an earnings stream. The result is less 'blackbox' earnings and less exposure to fancy, complicated products that can make short term profits but have a tendency for blowing up. They are not going to shoot the lights out but should continue to grow and distribute more profits to shareholders each year.