Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week Nike released solid fourth quarter and full year earnings which comfortably beat estimates, pushing the stock up 5% on Friday. Fiscal year revenues were up 10% to $30.6bn, this was up 14% if you exclude currency movements. Diluted earnings were up 25% to $3.70 per share for the year thanks to improving margins, share buy backs and of course solid sales growth.

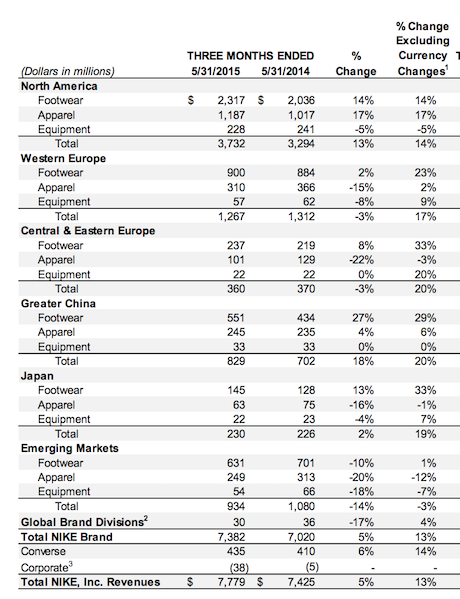

The table below breaks down their sales by region, and then between Footwear, Apparel and Equipment.

For the full year footwear represented 58% of sales and grew by 17%, Apparel represented 29% of sales and grew by 10% while equipment contributed 5.7% of sales and was up 1%.

The stock price certainly reflects the growth and growth expected. Trading at $109.70 it affords a forward multiple of 26 times next years earnings. But with earnings growth of 25% the PE ratio to growth is close to 1.

Now we need to ask the question, will Nike maintain this incredible sales growth and what will be the drivers behind it?

First and foremost, brand strength is incredible. They are the Apple of apparel and footwear. They have just won sponsorship of the NBA and already dominate the NFL. They sponsor most of the major sports teams and personalities around the world. Here at Vestact we believe that not only will the adoption of sports and active lifestyles go from strength to strength but also the viewerships and following of professional sports. It targets our inner instincts for competition, rivalry and pride for club or country. In female sports this is also growing fast. The ladies Football World Cup is currently underway and receives huge media attention. There are huge global sporting events all the time and they are receiving more and more attention, especially amongst social media.

Participation rates are also growing fast. In the US there were 25000 marathon runners in 1976. In 2013 there were 541000. In 1976 10% were women, today 46% of the runners were female.

Nike have also embraced and to an extent pioneered the shift to athletics wear as a fashion statement, it even has a name, Athleisure. This shift has been huge for their apparel sales and we expect this to carry on growing, especially as it gets embraced in developing markets.

Our Investment philosophy at Vestact is to select stocks which are leaders in sectors which we expect to grow faster than what the market expects. Even though the market has high expectations we still believe it is underestimated amongst apparel and sportswear. We continue to buy Nike shares at these levels.