Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont results have hit the screen this morning. Another "Swiss" company, this one of course has a primary listing in Zurich. Something that I guess could happen with Mediclinic in due course. The South African listed entity is the GDR, a Global Depositary receipt, for every ten shares that you own here in South Africa, it is equivalent to 1 share of the listed entity in Switzerland.

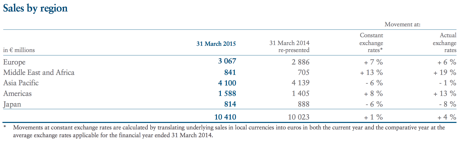

These results contain a number of moving parts, an investment property gain as well as a significant mark to market loss on cash (huh?). Sales grew by only 4 percent in Euro terms, only 1 percent at constant exchange rates. It was a tough year, the fastest growing segment of yesteryear, the Asia Pacific region registering lower revenues than in the prior year, both in constant and actual exchange rates. The reason why multi national companies have seen these currency headwinds or in the case of others, the wind at their backs is the vicious moves in global currency markets. Companies can try and hedge, there are always going to be factors out of their control, such as the losses incurred as a result of the Swiss National Bank removing the Dollar peg. Here is the global sales table:

Where do the cash mark to market come from? In the Chairman, Johann Rupert's overview, he explains: "In the short term, the revaluation of the franc against the euro resulted in a loss of some 686 million Euros for the Group, recorded as part of net financial expense in the profit and loss account. This was principally attributable to losses on Richemont's cash and financial investments. In addition, foreign exchange forward contracts taken out in line with the established hedging policy of the Group also lost value as a result of the euro's devaluation. Overall, exchange losses resulted in the 35 % drop in reported net profit for the year."

As he points out, that whilst the company is in Switzerland, they report in Euros. The companies that however hold the money market funds (Euros) and other cash are Swiss companies of Richemont. So when the year end was up, 31 March, the companies holding the Euros recorded Swiss Franc losses, due to the revised exchange rate. Not really complicated, yet unfortunately a reality and outside of their control. There were major financial institutions globally that were whacked by the Swiss National Bank moves.

So, I would say that possibly the best numbers to look at are a) Their cash position is higher than this time last year and b) the dividend is higher this year, meaning that the company is more confident with their future.

I suspect that there are always good reasons to own this company. As there are richer people on the planet that want the real deal, they want the quality in terms of brands and most especially the piece, be that jewellery or a watch. I often make the same observation about natural beauty, you cannot replicate the beauty of Cape Town, the tourism industry should thrive in that part of the world on an ongoing basis. Nice to look at, equally with brands centuries old, you cannot replicate that in a heartbeat, it takes forever. It is the standards that need to be maintained, as Richemont points out in the release, their costs are undoubtably going to be rising, they are however committed to Switzerland. That made in Switzerland is an enduring part of their business, core to quality.

Chairman Johann Rupert sums it up: "We believe that long-term demand for high-quality products will continue to grow around the world. Richemont is committed to supporting its Maisons to conceive, develop, manufacture and market products of beauty, individuality and the highest quality. These values are enduring and will see Richemont well positioned to benefit from an expanding market in the years to come."

In the same way that the company has these enduring brands, I think that the stock is undervalued. After having done some heavy lifting early, after BATS was unbundled, the share price has been quiet for a while. The stock first crested 100 Rand in August of 2013, in market terms (nowadays) that is light years ago. We first recommended them at the bottom of the market in 2009, the timing was excellent, it was both a strong rebound for the luxury goods industry, as well as the share price from very depressed levels. I suspect that we are at the same sort of levels now, after a crack down on gifting has come out of the system, the company is once again poised for growth, we maintain our strong buy.