Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

There have been two big announcements from GE in the preceding weeks;They are disposing most of GE Capital in the next 24 months and then they had their 2015 Q1 figures. The GE of late has always been a tale of two segments, industrials (for which they are known) and then GE Capital (which makes up the largest part of earnings). The share price jumped around 10% when they announced the sale of a large chunk of GE capitall, so the market likes the idea of moving to a more pure industrial play.

The theory is that the financial arms' earnings are too volatile for an industrial player like GE. The industrial assets don't get the same valuation in the market because they are diluted by the banking part of GE. (You can see it is not an ideal mix of assets).

The bulk of GE Capitals real estate assets will be bought by private equity company Blackstone and some of the loans business will be bought by Wells Fargo. The goal is to have GE Capital contribute only 10% of the earnings in 2018, from the current 42%.

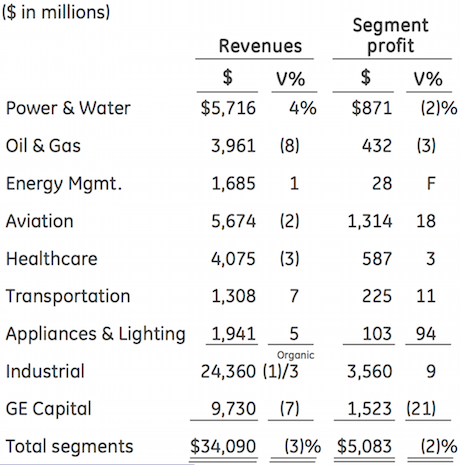

There are many moving parts to GE, here is the easiest way to see what is going on:

You will note that the industrial segments revenue went backwards by 1% but if we exclude the impact of the stronger dollar, revenue would have grown by 3%. Both Healthcare and Oil & Gas have positive organic growth but due to currency impact they also went backwards. In total the stronger dollar impacted revenues by $950 million.

Looking forward our focus needs to be on the Industrial segment as it is going to be the business post 2018. The industrial segment looks strong with earnings growth of 9% and operating margin expansion of 120 basis points. The company has nice diversification across many sectors, with one of them being the high growth healthcare sector. Add to all of this, GE plans to return to investors $90 billion in the form of dividends and share buy backs up until 2018. The conclusion drawn by all these numbers is that GE is a solid blue chip company that will probably be one of your most boring investments, they will chug along giving you a nice dividend yield (currently 3.2%) and grow earnings regularly.