Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

L'Oreal released a trading update for their first quarter a couple of days ago, and by couple I mean it in the classic sense, i.e. two. Talking of two's, today is the 22nd and the AGM of the company is today. Remember that the company has a pretty interesting set of shareholders, there is the history between the Bettencourt family and Nestle, which came about as a result of the French government wanting to nationalise everything in the 70's. The founder's (Eugene Schueller) daughter, Liliane Bettencourt was active in the business for years. According to Wiki, Liliane worked in the business from the age of 15, as an apprentice she would label shampoo bottles and mix cosmetics.

Indeed the roots of the business, excuse the pun, were in hair dyes. The very name Societe Francaise de Teintures Inoffensives pour Cheveux translates to the Safe Hair Dye Company of France. Bettencourt's daughter, Françoise Bettencourt Meyers and son-in-law, Jean-Pierre Meyers are both directors. The old man, Eugene Schueller was of German descent, he was of course French though. Wait, there is more. The next generation, the soon to be 29 year old Jean-Victor Meyers (the great grandson of the founder) is also a director in the business. Fourth generation ownership. I guess what you need to know as a shareholder is that there is a professional manager in the form of Jean-Paul Agon, a lifer at the company. He is 58 years old and has worked at the company since 1981. He knows the business as well as anyone else.

Who are the shareholders? On the front page of the digital annual report is the stunning Lupita Nyong'o, the Kenyan woman born in Mexico who starred in the equally stunning movie "12 years a slave". That movie was so sad that my wife could not watch it, have a read through to find all the information that you need, starting with brands. As per the website, the Bettencourt family owns 33.09 percent of the shares, Nestle own 23.14 percent, International Institutions own 28.06 percent, French institutional investors own 8.43 percent, Individual shareholders own a mere 5.22 percent. Staffers own 0.81 percent and the balance, 1.25 percent is Treasury stock. The family is still large and in charge, the last move by Nestle was to reduce their stake. We often thought that Nestle would be tempted to own the rest of it, perhaps the French government would never let it happen and the Swiss company knows this.

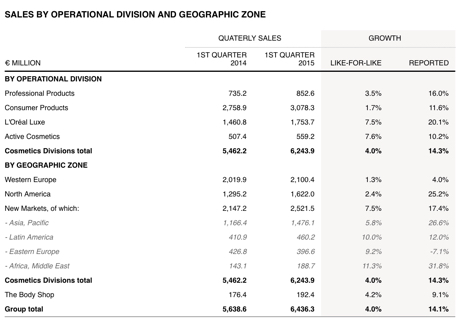

Background info finished, back to the FIRST QUARTER 2015 SALES. I took the table of the sales update so that you can see which areas are strongest, compared to the others. You can see that the currency had a marked impact on the Euro reported sales, on a constant basis (i.e. all currency moves are ignored, local sales only) growth was a reasonable 5.2 percent. That is OK, their two biggest areas of sales are still North America and Europe. Eastern Europe was the only territory to go backwards, notwithstanding the fact that L'Oreal are winning market share there. Here goes, see for yourself:

What to do about your shares? Nothing. Doing nothing means that you are not tempted to sell, the Dollar returns for L'Oreal have not actually been as good as the Euro returns, understandably of course. What do I mean by that? Over the last 12 months the ADR in New York has returned 13.65 percent (not too shabby Nige), whilst the French listed business is up a whopping 46.8 percent, the market cap is about to crest exactly 100 billion Euros. We continue to hold the company through the wild currency gyrations, knowing that a weaker Euro has an impact on the Dollar share price (negatively), at the same time a weaker Euro is positive for reported sales. Take the currency fluctuations out and know that you have a quality business that is beating their peers globally, taking market share in the mature markets and growing fast in the developing world, which now represents more than 35 percent of the business. We maintain our accumulate stance.