Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Well done Byron, last week he had a pretty forward headline in the daily message which was less than subtle, it said buy Aspen. And quite a few of you responded, this was in response to us covering the trading update, which was not favourably received by the market. They were trading at R413 that day, today we are back at R435 a share. The results themselves once again underscore why in this phase of high growth the company is tricky to value. The stock is up over 50 percent in twelve months. Why? For the half year the company grew revenues by 51 percent, thanks to all the acquisitions that the company has done. Gross profits grew by 52 percent. The strong Dollar globally has actually had quite an impact on Aspen. As much as 343 million rand for the half year or 67 cents of earnings per share can be attributed to foreign exchange losses. The Russian Rouble and the Venezuelan Bolivar performed poorly.

As a result of all these acquisitions, the funding costs have increased by a factor of three, not small. Aspen is however a very profitable business, and are able to service debt quicker than most. Net borrowings at the end of the period was 28.6 billion Rand, 34 percent of that here in South Africa, 15 percent in Asia Pacific and the balance in their "International" division. Profits after tax for the half year were 2.458 billion Rand on just over 18 billion Rand worth of revenue, this business is highly profitable. That translated to headline earnings per share of 541.7 cents, an increase of 28 percent on the half year results.

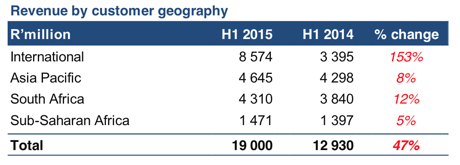

Where has most of the growth come from? In terms of revenues it is all of the acquisitions that they have made in Europe mostly, Western Europe at that and mostly commercial sale, which is all anticoagulants (which is also in Eastern Europe). The other big driver has been the infant formula in Latin American, which saw sales in that geography more than double. Here are a series of slides which explains it, taken from the presentation. First things first, revenue by geography, International is North America, Europe, Latin America and then Middle East/North Africa.

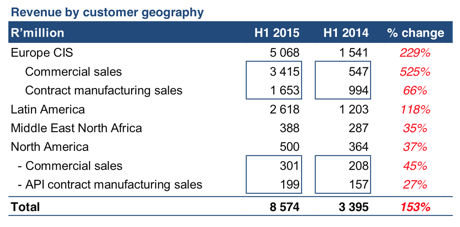

And then drilling down into the international segment (all the stuff that they have bought), reveals what we had spoken about above, the wide spread business in Europe.

The aforementioned ugly twins of Aspen's growth markets have hit the skids, when the company talks about the international segment in the prospects column: This segment is, however, also exposed to political and economic instability in Venezuela and Russia, two countries in which Aspen had been expecting material growth. Remittance of funds to pay for products supplied to Venezuela has become significantly constrained. The sharp devaluation of the Ruble in recent months has significantly diminished the value of the business undertaken in Russia. I guess until those two territories are sorted (who knows when that will be) they won't be solved. One thing is for certain, people always need pharma products.

Notwithstanding that at all, the last paragraph of the results tells you that Stephen Saad and his team are ALWAYS on the lookout for new opportunities. See: "The restructuring and consolidation which is currently prevalent in the global pharmaceutical industry is creating a number of acquisitive opportunities as businesses are re-sized and re-shaped. Aspen is well placed to participate in this process and executive management is actively engaged in assessing possibilities. The Group has a proven capability to successfully execute complex multiterritory transactions, which makes it a strong candidate for such opportunities."

They are going to nail down the recent acquisitions across Europe, which is starting to look more and more favourable. They are going to continue to sweat smaller assets harder, Stephen Saad is extremely energetic and a big personal shareholder in the business too. The risk is of course that he decides to spend more time with the Sharks rugby team or his conservation efforts, I can tell you that he never seems to lose his energy with this business. The company is not only in great hands, is growing fast, attracting new talent and new drugs and formulas, it is also a truly international one, as you could tell from the rather large currency impairment they took. Hey, it is going to happen that way if you have many international businesses.

Growth in their Asian business (which is only 4 odd percent) is key to the prospects of Aspen, they no doubt will work really hard there. Ironically their biggest sales region in their Asia division is Japan, you will recall the deal: Japan rises with GSK! See that, Japan is the second biggest pharma market in the world.

On a 30 multiple forward, with expected EPS of around 14 Rand a share, the stock is by no means cheap. It is however never cheap, I remember when the company traded at 30 Rand a share, which was when we first started buying them, the PEG ratio (PE over Growth) was at the same level as it is now. There may always be a time of consolidation, that is a great time to continue to acquire what we think is a fabulous company with great prospects. Buy.