Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received 6 month results for the period ending 31 December 2014 from Discovery. This is our only recommended stock that falls within the financial services sector. Although there is a big healthcare element to this business which they have targeted as a disrupter in the industry. More on that later, lets first look at the financials.

Total new business for the period increased 17% to R6.6bn. Normalised headline earnings were up 20% to R1.98bn. This equated to headline earnings per share of R3.40. If we simply annualise this number to R6.80 we get a forward 2015 PE of 17, currently trading at R116. I wouldn't call that expensive considering the growth of this business. But there are other ways to value insurance businesses.

Embedded value was up 14% to R45.5bn. Embedded value is an actuarial term which equates to the sum of the adjusted net asset value and the present value of future profits of the company. This can be fairly accurately calculated because once an insurance company locks in a client they know what premiums they will receive on an annual basis. The actuarial estimations comes from the claims expected to be paid out. Discovery's market cap of 67.5bn sits on a 48% premium to the embedded value. Again I wouldn't be concerned. We feel that Discovery, with their superior product will steal market share faster than what the market expects. We also feel that their health initiatives will decrease claims faster than what the market expects.

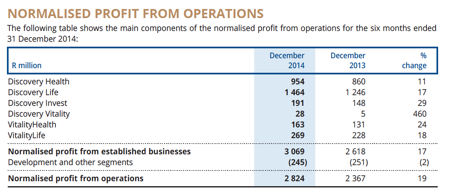

Lets look at the operations of the business. Here is a table from the presentation which shows the different divisions and how much money they make.

As you can see the South African Life insurance business is by far the biggest profit driver. But of course this links to the health business which incentivises clients to be healthier, stay alive longer and of course pay those life insurance premiums for longer without claiming. These 2 big profit drivers are the core of the business and should benefit from a growing market share amongst a growing middle class.

It's nice to see Vitality making a profit. This initiative was originally expected to break even whilst improving the product. They of course cover the difference of all those gym, flights and food discounts. It turns out that they have built such an incredible product that they are able to franchise it out to other insurers and even corporates around the globe.

VitalityHealth and VitalityLife are the rebranded UK businesses after they bought the remaining 25% stake from Prudential. These businesses are showing solid growth. Apparently the participation rate of the Vitality initiatives in the UK are brilliant and people are really embracing and enjoying the product. I expect this business to become more and more significant and the geographic diversification into a developed market is also a great plus.

Ping An Health, their stake in the Chinese insurer still has plenty of potential. But the stake is small and the money flows are not significant enough to make the table. We back management to turn this opportunity into a great business.

The short term insurance has also not made the table of profits because it in fact made a loss. They are pushing this business hard and spending a lot on improving the product. New business actually grew 57% to R403 million. Discovery Invest has seen solid inflows as they leverage off their great brand and huge client base.

As mentioned above, this business is a disrupter in a very old industry. They have realised that as an insurer their interests are aligned with their clients. So they have created incredible products to incentivise their clients to alter their behaviour. And it turns out that clients actually want to be healthy and actually want to avoid car accidents if you give them the right platform to take it seriously.

This is not the last we will hear from Adrian Gore and his team. They have announced a rights issue to raise up to R5bn in order to fund the UK acquisition as well as an opportunity they have earmarked in SA which they have not yet disclosed. More on that when we have further details. I am very pleased with these results. We will continue to add and we will advise clients to follow their rights which will be at a juicy discount, R90 a share.