Market scorecard

US markets started the new month on a positive note with both the S&P 500 and Nasdaq edging higher. November is typically a good month for US stocks, with the S&P 500 rising 59% of the time since 1927, according to Bank of America.

In company news, Kenvue, a consumer health conglomerate spun off from Johnson & Johnson in 2023, surged 12.3% after Kimberly-Clark announced a $40 billion takeover, forming a group with assets ranging from Tylenol to Huggies. Elsewhere, Palantir shares fell 4% after-hours, following "the best results that any software company has ever delivered" (according to their nutty CEO). Finally, Microsoft announced yet another AI infrastructure deal, pledging to spend over $7.9 billion in the UAE.

On Monday, the JSE All-share closed down 0.15%, but the S&P 500 added 0.17%, and the Nasdaq moved another 0.46% higher. Let's go Santa.

Our 10c worth

Bright's banter

Here's another 3rd quarter earnings update from one of our core portfolio stocks. Apple delivered record sales of $102.5 billion, up 8% year-on-year and ahead of expectations. Earnings per share came in at $1.85 versus an anticipated $1.77. iPhone revenue rose 6.1% to $49 billion, slightly below estimates due to supply constraints rather than weak demand, with most buyers opting for the high-end iPhone 17 Pro models.

Services revenue climbed 15% to $28.8 billion, pushing annual services income beyond $100 billion for the first time, an increasingly vital profit engine supported by the $20 billion annual search partnership with Google.

China remains a soft spot, with sales down 3.6% to $14.5 billion, but management expects a rebound as iPhone 17 demand accelerates.

The company predicts December-quarter revenue growth of up to 12% (compared with 6% expected). On the earnings call, CFO Kevan Parekh predicted a massive festive season, their "best iPhone quarter ever", thanks to new AI tools anchored by a redesigned Siri, a smart-home ecosystem, foldable iPhones, and refreshed Macs with M5 and M6 chips.

Apple may only be up 10.3% year-to-date, but never doubt its resilience and ability to print cash for patient shareholders. This is a steady, cash-rich business and still the benchmark for hardware innovation.

Apple's cash flow and pricing power continue to shine. Despite tougher competition, the company's ecosystem stickiness and expanding services margins make it a core compounder in our portfolios.

One thing, from Paul

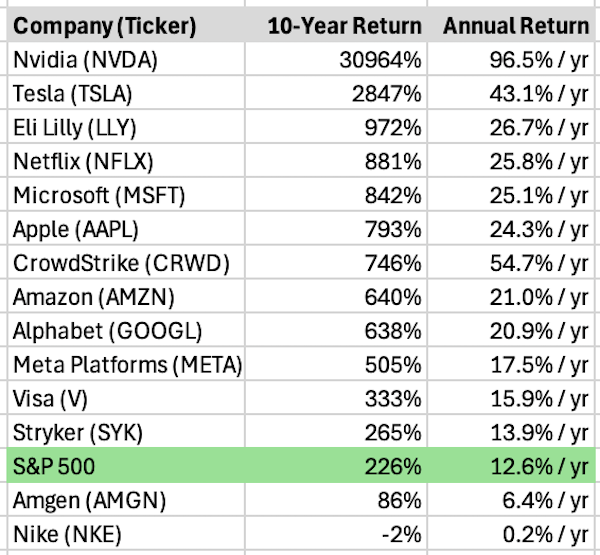

We often point out that to do well in the stock market, you have to accumulate the shares of high-quality companies and then hold them for a very long time. But what's a long time? I'd say it's at least a decade.

So how do the decade-long returns of our recommended stocks compare? For starters, let's look at the benchmark, the S&P 500. It's up 226% in the last ten years. That translates into an annualized return of 12.6% per year.

I asked ChatGPT to gather the numbers for our 14 most-widely held stocks, which took it about 5 minutes of trawling the web, scraping data and number crunching. I checked the results manually on the Apple stocks app, which has a handy 10-year chart feature that is right up to date.

The results are shown in the table below, and incorporate stock splits. Also, note that CrowdStrike has only been listed since 2019.

We've had a lot more winners than losers, relative to our big-cap stock benchmark. Holding Nvidia has been a blast, Nike not so much.

This is a backwards-looking exercise. Our suggested portfolios for new investors are designed to deliver the best results for the next 10 years, ending in 2035.

Byron's beats

Netflix is doing a 10-for-1 stock split on Friday 14 November. If you are one of the 358 Vestact clients that has Netflix in their portfolio, you will notice that on Monday 17 November you will own 10 times more Netflix shares but the share price will be trading at 1/10th of the usual price. In other words, nothing changes to the value of your Netflix holding.

Companies do stock splits for various reasons but the most common one is because the share price has become too high and retail investors are being excluded from buying the share. Netflix currently trades at around $1 100 which is quite chunky.

We welcome stock splits because they make our lives a lot easier when it comes to client portfolio allocations. In this case everyone wants this, unlike the hit Netflix show Nobody Wants This.

I hope the Booking Holdings management team is paying attention. That stock trades at around $5 000 a share which is crazy.

Michael's musings

Amazon closed 4% higher yesterday after announcing a $38 billion deal with OpenAI. The ChatGPT maker has agreed to buy AWS computing power over the next seven years, adding to the flurry of deals signed recently which now total over $1 trillion. These include $300 billion from Oracle and $250 billion from Microsoft's Azure. OpenAI will need some serious growth and cash flow to pay for all that computing power.

In a recent podcast, OpenAI's CEO Sam Altman said that the market had missed the mark in assuming that their current revenue was 'only' $13 billion. Altman also hinted at OpenAI being on track to hit $100 billion in revenue by 2027, which is crazy growth. According to ChatGPT, Amazon was the quickest company to $100 billion in annual revenue, taking 21 years. If OpenAI can do it in 2027, they would have taken 12 years. It is even more impressive when considering that they only had $200 million in revenue in 2022.

Some market pundits are comparing the current market rally to the dot-com bubble, but that's not right. Back then, companies had massive values but almost zero revenue and no profits. This situation is completely different now, which OpenAI's revenue growth demonstrates.

Linkfest, lap it up

America has a huge obesity problem. Thank goodness for GLP-1 drugs - US obesity rates are finally levelling off.

F1 is the 'it' sport at the moment. Apple is replacing ESPN as the US broadcaster - F1 to be paid $140m a year in 5-year deal.

Signing off

Asian markets are a mixed bag this morning. Japan edged lower in post-holiday trade, and Australia was down sharply, with BHP off nearly 3% and Commonwealth Bank 2% lower.

In local company news, Pepkor shares ticked higher after the retailer predicted a 10 to 20% jump in full-year earnings due to strong growth in its fintech arm and resilient performance across clothing, furniture, and general merchandise.

US equity futures are trading lower pre-market. The Rand is at around R17.35 to the US Dollar.

That's all for now. Have a good day.