Market scorecard

US markets slipped yesterday as "profit-taking" in big tech dragged major indexes lower. Meta tumbled 11% and Microsoft was down nearly 2.9% after investors fretted about their aggressive capital spending on massive data centres.

In company news, Eli Lilly lifted its full-year outlook due to booming sales of Mounjaro and Zepbound widened its lead over rivals, pushing its stock up a pleasing 3.8% Elsewhere in obesity news, Novo Nordisk has made an unsolicited bid for US biotech Metsera, setting off a bidding war with Pfizer. Finally, Amazon gave its naysayers a hiding after the bell, delivering astonishingly strong results and powering 13.2% higher in late trade.

Izolo, the JSE All-share closed down 0.64%, the S&P 500 fell 0.99%, and the Nasdaq was 1.57% lower. Oof.

Our 10c worth

Michael's musings

On Wednesday night, Meta released a strong set of numbers; revenue increased 26% compared to last year, beating expectations, and earnings rose 34% year-on-year, also a beat. Unfortunately, there was a one-off, non-cash $16 billion write-down on some deferred tax assets, due to legislative changes in the tax code, which muddied the picture.

The main talking point after the results was the eye-popping increase in capital expenditure (CapEx). For 2025, Meta expects to spend between $70 billion and $72 billion, at the top end of their previous guidance. Then, they plan to splash out over $100 billion in 2026. This acceleration in CapEx made the market nervous, and the share price dropped 11% yesterday.

In addition to the accelerated outlays on new data centres, Meta's operating costs rose 32%, outpacing the 26% revenue increase, as the company threw huge sums of money to hire top AI talent. Meta is putting all its 'chips' on AI, and that's leading to a bit of investor anxiety.

Some might be having flashbacks of 2022 when the company plunged headlong into an ill-conceived plan to build the metaverse; it even renamed itself from Facebook to Meta.

We are less worried for two key reasons. The increase in computing power has allowed Meta to offer a more targeted and valuable offering to advertisers. Additionally, improved computing power has led to increased user engagement through features such as the ability to add subtitles to videos. Happier advertisers and users are both big positives for the business.

Secondly, if Meta finds that they really have too much 'dead' computing power, they will be able to sell it off. There is so much demand at the moment for data centre capacity, that Meta shouldn't have a problem finding buyers.

There is no doubt that AI is the future of computing, and that the winners of the AI arms race will be smiling for the coming decade or two. As a result, Mark Zuckerberg is doing all he can to ensure that Meta is one of those winners. From our perspective, this looks like a good strategy.

One thing, from Paul

It's Friday, so I'll avoid further market commentary and dish out some interesting comments about psychology.

There are some famous experiments from the last century that went viral and ended up as received wisdom, but failed to replicate in recent years. Here's the post that got me onto this topic: Cognitive studies, replication crisis.

My favourite example is the 1990 study that said kids who pass the Marshmallow Test will do well in later life. If they could resist eating a marshmallow when left alone in a room at age 4-5, they would supposedly do well in life. It turns out that children usually make a call on scoffing the marshmallow based on their perception of the reliability of the person serving them.

Here are some other failed ideas that you might hold dear.

A 1998 study suggested that people have a willpower battery that gradually depletes during the day. Supposedly, it gets harder to do hard things in the afternoons and evenings. Nope, failed to replicate.

The Mozart Effect claimed in 1993 that listening to Mozart temporarily makes you smarter. Also failed on a retry.

A study that bilinguals are smarter suggested that speaking at least two languages fluently provided substantial cognitive advantages in attention, task-switching, and executive control. No, not really.

One last one, which is especially well-known, from 1999, the Dunning-Kruger Effect alleged that low-ability individuals believe they're better at tasks than they really are. In other words, they are so dumb, they think they are good at their jobs. Sadly, follow-up studies in the 2020s have found that effect to be more limited and weaker than originally reported. What a pity! I used to use that one all the time, when talking about South African politicians.

Byron's beats

I sometimes ask myself if it is unpatriotic for South Africans to invest their hard-earned savings offshore? I don't think so. I love this country but I really don't regret encouraging locals to invest their money in places where there is more respect for capital.

The service we offer actually makes South Africa a better place. By giving South Africans access to the US stock market, we have allowed them to invest in the biggest and best companies in the world. Most of our clients live in this country and are large contributors to the economy via consumption, taxes, business creation or offering valuable services. If they weren't able to grow their savings offshore, I imagine many would have left the country by now, leaving us worse off.

Because most clients have done very well, quite a few of them are now bringing money back, buying holiday homes, investing in passion projects like schools, making donations or starting businesses that they never would have attempted if they didn't have the cushion of a large US equities portfolio.

By giving people choices and offering them a quality product, you are fixing a problem and improving the economic environment around you.

Bright's banter

As the young and cool one in the office, it's my duty to keep everyone updated on the latest market acronyms - and friends, there's a new one in town: BATMMAAN.

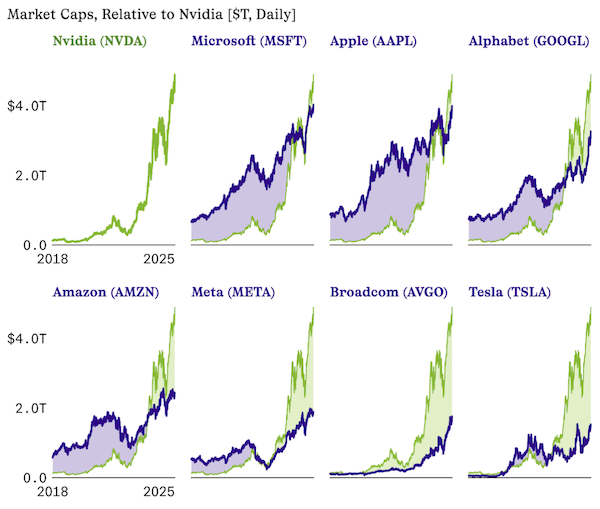

Nvidia just crossed the $5 trillion mark, making it the first company to ever do so. This happened after CEO Jensen Huang announced over $500 billion in orders for their next-gen Blackwell and Rubin chips, plus fresh partnerships with companies like Palantir, CrowdStrike, and Uber.

Nvidia is not alone in this trillion-dollar playground. Broadcom, now worth over $1.78 trillion, has officially joined the elite, prompting the rebrand from "Magnificent 7" to BATMMAAN - that's Broadcom, Apple, Tesla, Microsoft, Meta, Amazon, Alphabet, and Nvidia. Together, they're now worth a jaw-dropping $24 trillion, roughly 40% of the entire S&P 500.

Just remember, when your older colleagues ask what BATMMAAN stands for, try to say it with a straight face.

Linkfest, lap it up

Black Friday is coming up soon. Are you thinking of buying a new TV? - Research shows 4K or 8K screens offer no distinguishable benefit.

Call an old friend. People are going through a lot - It will make their day.

Signing off

In Asia, markets are mixed. But the Nikkei 225 in Tokyo just hit an all-time record high. Nissan forecast a 275 billion Yen ($1.8 billion) operating loss for the year as it ramps up cost cuts to steady its finances. Meanwhile, BYD's profits slumped again amid fierce price wars and mounting regulatory scrutiny in China's EV market.

In local company news, Dis-Chem CEO Rui Morais says the retailer's turnaround is as much about culture as commerce, with a focus on uniting its 20 000-strong workforce behind accessible healthcare, a shift reflected in a 9% rise in earnings and steady expansion across SA.

US equity futures are back in the green pre-market. The Rand is trading at around R17.30 to the US Dollar.

Have a great weekend. Happy Halloween, for those who celebrate.

Sent to you by Team Vestact.