Market scorecard

US markets gyrated sharply yesterday after the Fed cut rates but signalled that a further reduction in December wasn't a foregone conclusion. The Nasdaq outperformed the S&P 500, thanks to Nvidia, which blasted past the $200 per share level, to become the first $5 trillion company ever.

In company news, Google jumped over 6% after-hours thanks to posting third-quarter results that beat the street, fuelled by strong AI-driven growth in its cloud business. Elsewhere, Meta shares fell more than 7% in late trade because of a $16 billion one-time US tax charge, tied to provisions in Donald Trump's "One Big Beautiful Bill" act. Finally, Microsoft reported excellent Azure cloud numbers, but amped up capital spending to such an extent that the stock slipped 4%. We'll have more about those three in the days ahead.

When all was said and done, the JSE All-share closed up 0.50%, the S&P 500 was unchanged, and the Nasdaq was 0.55% higher. We live in exciting times.

Our 10c worth

Bright's banter

Visa's fourth-quarter numbers showed that the global payments giant is still the quiet beneficiary of humanity's spending habits. On Tuesday night, the payments giant reported revenue up 12% to $10.72 billion, just ahead of expectations, driven by a 9% jump in payments volume.

There's a lot of noise in the news, but global consumers continue to spend freely on everything from travel to petrol. Adjusted earnings per share came in at $2.98, a whisker above consensus, translating to a 7% rise in adjusted net income to $5.8 billion.

Visa is an anchor holding in Vestact portfolios because it's a toll taker on global commerce that's still compounding at scale. Its unmatched acceptance, brand, and risk systems create a moat that rivals rent rather than breach.

Both discretionary and essential spending picked up in the US, while cross-border volumes climbed 12%, and e-commerce still accounts for about 40% of Visa's international business. The company's highest-earning clients are spending the fastest, proving that even in a cost-of-living squeeze, premium cardholders still swipe with confidence.

Visa expects revenue to rise by a low double-digit percentage this full financial year, with analysts pencilling in 12% for the first quarter and 10.5% for the whole 12 months. The company doesn't want to be left behind in innovation and product development, which will help it scale and enable its payment partners to build on its existing suite of services.

Visa is quietly preparing for a future where you might not even make the purchase yourself. CEO Ryan McInerney said Visa is enabling "agentic" transactions. These are AI-powered agents that check out on your behalf, and build systems to verify that those bots aren't up to mischief. I'm still skeptical, but interested to see how this will be implemented.

Stay long Visa. It's another trillion-dollar company in the making.

One thing, from Paul

The focal point of my week will be today's results from Eli Lilly. They should hit the wires around lunchtime in Joburg, before the market opens on Wall Street.

That's not to say I haven't been drawn into all the excitement about AI, eyepopping sales of Nvidia chips, and earnings reports from their major customers. That's been epic!

We have a lot riding on Lilly's new GLP-1 weight-loss drugs, having recommended the stock to 866 Vestact clients so far. I'll be on the edge of my seat, waiting to see the market's reaction to sales numbers for the high-powered injectable versions, Mounjaro/Zepbound, and commentary about the soon-to-be-released and slightly less-effective oral version, Orforglipron (new name coming soon).

On that note, Lilly has already mass-produced enormous amounts of Orforglipron, despite the fact that they haven't yet received final approval for it from the FDA, their regulator. They expect to get that wrapped up before the end of the year, after exhaustive testing. They are clearly anticipating blockbuster global sales when it goes on sale next year.

"We've already made, actually, billions of doses preparing for the launch," Chief Executive Officer Dave Ricks said on Monday.

Byron's beats

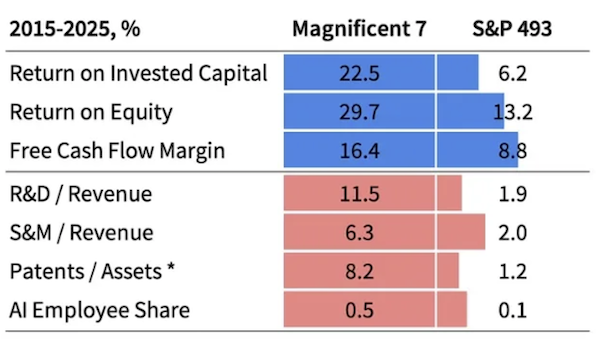

I saw some interesting research that compares the Mag7 to the remaining 493 companies in the S&P 500 over the last 10 years. In case you needed reminding, the Mag7 consists of Google, Apple, Amazon, Nvidia, Tesla, Meta and Microsoft. All 7 have been part of the Vestact recommended portfolio for many years.

The return on capital (ROC) invested by the Mag7 has been 22.5% since 2015. The S&P 493 has achieved 6.2% over that 10-year period. Return on equity (ROE) for Mag7 was 29.7%, and the S&P 493 achieved 13.2%. Free cash flow (FCF) margins for the Mag7 have been 16.4%, the S&P 493 was 8.8%.

The Mag7 stocks have grown in size because, as companies, they have been able to achieve much better results than the rest of the stocks in the index. It's as simple as that. We are comfortable being overweight these wonderful businesses, along with a handful of others we have carefully selected.

Michael's musings

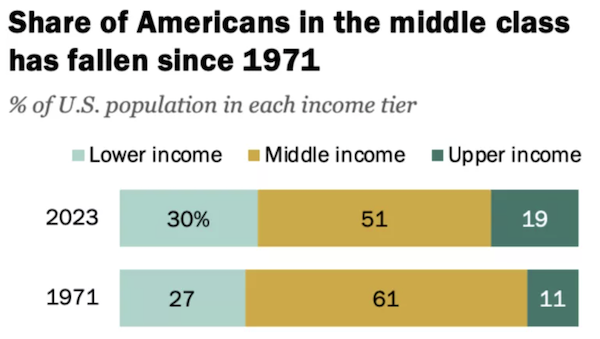

An acquaintance was telling me at a braai recently how American capitalism had failed because its middle class is shrinking, while the low-income group is growing. His argument was that the top 1% was 'taking' all the money, hollowing out society in the process. From all my readings, his assessment sounded wrong, but I didn't have the figures on hand to give a proper counterargument.

It turns out he was correct, the middle class has shrunk, and the low-income segment of society has also grown. What he failed to mention is that high-income earners are growing quickly, and most of the people leaving the middle class are going up, not down. So, he was dead wrong to say only a select few were benefiting in the US.

The entire exercise served as a reminder of how easily facts can be distorted to fit a narrative. When approaching any debate, it's important to have the full picture. Unfortunately, in today's society, most people obtain their news from social media, which often presents only one side of an argument.

Linkfest, lap it up

Modern life is characterised by the explosion of choice. Freedom has come to mean having a huge array of options - Did we take a wrong turn?

Net income is the number that matters most to investors. The higher the profit margin, the less effort is required to grow profits - S&P 500 margins have more than doubled since the 90s.

Signing off

The mood in Asia seems positive, after a cheerful meeting between Trump and Xi. In fact, The Donald said: "On a scale of 1-10, the meeting with Xi was a 12".

In Japan, SK Hynix reported a 62% surge in profit and said its entire 2025 chip lineup is already sold out, a clear sign that the AI infrastructure boom is driving demand across the semiconductor industry.

In local company news, Glencore trimmed its full-year guidance and reported a 17% drop in output for the first nine months.

US equity futures are still in the green pre-market. The Rand is trading at around R17.19 to the US Dollar.

Today, we will see third-quarter numbers out from Apple, Amazon, Stryker, and Paul's beloved Eli Lilly.

Keep busy, and enjoy your day.