Market scorecard

US markets extended their record-setting run yesterday. Optimism about the AI revolution is keeping the bull market alive.

In company news, Nvidia surged 5% to close with a market cap just shy of $4.9 trillion after announcing a slate of new partnerships at its Washington conference. Elsewhere, UPS jumped 8% after lifting its annual outlook and announcing job cuts (that's a good combo). Lastly, Booking Holdings rose 4% in late trading as it beat expectations with strong third-quarter gross bookings, signalling resilient travel demand across its brands.

At the closing bell, the JSE All-share was 1.02% higher, the S&P 500 added 0.23%, and the Nasdaq advanced by a respectable 0.80%. How wonderful.

Our 10c worth

One thing, from Paul

This week, five of our core portfolio holdings will report their third-quarter results: Microsoft, Google and Meta tonight, and Apple and Amazon tomorrow.

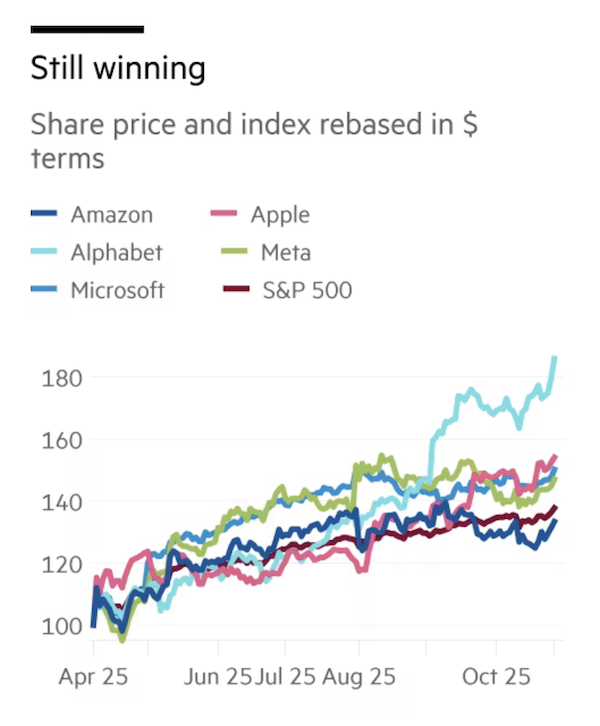

The chart below, which I pinched from the FT, shows how they've all performed since the market lows of April 2025. Amazon has trailed the S&P 500 slightly, and Google (aka Alphabet) has shot the lights out.

The core thing we'll be looking for is the delicate balance they are each striking between sales growth (actual revenue coming in), capital spending (mostly on AI infrastructure) and earnings (maintaining margins and profits).

Four of the five companies have basically doubled capex over the past two years, and they are expected to keep their feet on the accelerator for the foreseeable future. Will they sell enough AI products and services to generate an acceptable return on these huge datacentre investments? We think so, yes.

Note that Apple is the odd one out, spending very little, and betting on its fabulous iPhone, iPad, and MacBook devices to reap the benefits of AI without paying to build it.

Buckle up, it's going to be an exciting few days!

Byron's beats

The relationship between Microsoft and OpenAI has been pretty complicated since Microsoft first invested $1 billion in the non-profit organisation in 2019. It was also impossible to value their stake.

Yesterday, the two entities announced a fresh agreement that should clear up a lot of these issues. Under the new partnership, Microsoft gets 27% ownership of the for-profit part of OpenAI, worth $135 billion. Their outlay was $13 billion, so this has been a solid 10-bagger over a relatively short period.

Microsoft will also retain access to OpenAI's technology up until 2032. Remember, Microsoft Copilot competes directly with ChatGPT but uses a lot of its IP.

Lastly, OpenAI has made a $250 billion commitment to use Azure, Microsoft's cloud service. That's huge. This deal sounds like a win for Microsoft which is very pleasing for its shareholders (including most Vestact clients).

Michael's musings

Most people strive for financial independence; being your own boss, doing a job you like, with the flexibility to travel and 'live' life. It was out of this that the FIRE (Financial Independence, Retire Early) movement emerged, and over time, different branches have formed.

There is a growing community on social media punting the idea of putting all your savings in high-yielding products, and then quitting your day job. The plan is that regular dividends or interest payments then substitute your salary. The high-yielding products are structured to sacrifice long-term asset price growth in favor of cash flow today.

The idea is that you are only young once, so having access to cash flow now is valuable. When you are young, I can understand why this approach is attractive. I'm not so sure 'future you' will be as appreciative, though.

Long-term compound growth is the secret to building real wealth, and that requires your money to be invested for decades. Unfortunately, by sacrificing long-term asset price appreciation for money now, you also sacrifice a vital component of serious wealth formation.

Bright's banter

Mercor has become the unlikeliest winner of the AI boom, a startup that pays humans to train the machines that could one day replace them. The company is finalising a $350 million funding round valuing it at $10 billion, five times its worth in February.

Its clients include OpenAI and Anthropic, and it manages 30 000 contractors, including lawyers, doctors, bankers, and journalists, who help chatbots learn how to think and sound more human.

The founders, Brendan Foody, Adarsh Hiremath, and Surya Midha, met in high school in the Bay Area, dropped out of university, and joined Peter Thiel's fellowship for young founders. They first built a recruiting startup using AI to match candidates to jobs, inadvertently amassing a database of skilled professionals. When AI companies came knocking for human help, Mercor pivoted and never looked back.

In recent times Mercor's revenues have quadrupled. It's now the gig economy's strangest twist, white-collar workers earning $85 to $135 an hour to train their replacements.

Linkfest, lap it up

Find something worth bothering about. Otherwise, you'll start irritating people around you without knowing it - We are creatures of purpose.

The SARB has a 3% inflation target. The hardest part of reaching that goal will be resetting expectations lower - Metalworkers say a 6.5% increase offer an 'insult'.

Signing off

Asian markets are mixed this morning. Japan is sharply higher and Hong Kong is closed for Chung Yeung Day. In China, Private equity firm Boyu Capital has reportedly taken the lead in Starbucks' bid to find a partner for its $4 billion-plus Chinese business.

In local company news, Old Mutual announced that it's buying a majority stake in index tracker giant 10X Investments for R2.2 billion, a move that deepens its fintech footprint and mirrors the trend of big financial institutions teaming up with digital disruptors.

US equity futures edged higher pre-market. The Rand is trading at around R17.15 to the US Dollar.

We have a big earnings night ahead of us, which will be worth waiting up for.

Over and out.