Market scorecard

US stocks kicked off the week in an exuberant mood, extending last week's rally and closing at fresh record highs. Optimism over warming US-China trade relations, an expected Fed rate cut, and strong corporate earnings kept sentiment buoyant. What's not to like?

In company news, Lululemon Athletica is teaming up with the NFL and Fanatics to create a line of fan gear, marking the yoga-wear brand's latest move to stretch into new growth markets. Elsewhere, Johnson & Johnson faces a 17% surge in new cancer-related baby powder lawsuits after a US court rejected its latest bid to settle the claims through a partial bankruptcy trick. Lastly, Berkshire Hathaway got hit with a rare sell rating by an analyst at KBW, who noted earnings headwinds, Warren Buffett's exit, and broader macro risks.

At the close, the JSE All-share closed down 1.57%, but the S&P 500 rose 1.23%, and the Nasdaq was 1.86% higher. Wow, look at that.

Our 10c worth

One thing, from Paul

Amazon currently employs 1 560 000 people globally. It has hundreds of thousands of warehouse workers, an army of contract drivers and layers of managers to hire, monitor and supervise employees.

Their US work force has more than tripled since 2018, but two recent announcements suggest that growth is about to slow rapidly.

First, the New York Times reported that Amazon hopes to replace more than 500 000 low-end jobs with robots. Their automation team says it can avoid hiring more than 160 000 people in the US it would otherwise need by 2027, and save about 30 cents on each item that Amazon picks, packs and delivers to customers.

The jobs being phased out are at the lowest rung, in noisy, unpleasant facilities, and are physically challenging and repetitive. The cuts are part of an ongoing effort to correct an aggressive hiring spree during the Covid pandemic, when Amazon doubled its warehouse network over a two-year period.

Second, in overnight news, Amazon said it will cut up to 30 000 corporate jobs, roughly 10% of its white-collar workforce, starting today. Pink slips will go out to managers in its human resources, cloud computing, advertising and other business units.

We are shareholders in Amazon, so we applaud these developments. CEO Andy Jassy is to be commended for driving AI adoption, efficiency and superior profit margins.

Byron's beats

The investment appeal of Chinese stocks seems to come and go, depending on how the regulators there are feeling. In the absence of crackdowns by Beijing, Sino corporates seem really attractive. Currently, the general consensus seems quite positive and a few clients have asked us how to get exposure to that economy.

According to The Compound Podcast, US tech stocks have the highest revenue exposure to China by sector with 10.6%. That is more than double the 4.2% exposure of the S&P500.

Out of the Mag7 stocks, Tesla has the highest exposure with 20.9%. Apple, Nvidia, Microsoft and Meta are all above 10%. So if you want some exposure to China, your Vestact portfolio has you covered. I would say 10% is more than enough.

Michael's musings

We have been pretty vocal that the Trump tariffs are a bad idea. It's still too early to know the exact ramifications of these new taxes on American consumers, but data is starting to roll in.

According to Goldman Sachs, end-buyers of US goods are absorbing 55% of tariff costs, US businesses are sucking up around 22%, and foreign exporters are absorbing 18%, with the rest being a rounding error. A different report from S&P Global estimates that consumers are taking two-thirds of the cost increase, with the rest coming from corporates giving up profits.

In many cases, corporates can't just flick a switch and increase prices, so these increased costs from tariffs will take time to filter through to the consumer. I have little doubt that in a few years from now, the consumer will be carrying even more of the burden.

I was chatting to staff at a South African company that specialises in courier services for local businesses selling to the US, and they have seen a 56% drop in freight volumes. Some of that will return as tariffs settle, but a chunk will never come back.

I suppose that's what the White House wants - more stuff manufactured in the US. Of course, Economics 101 tells us that a closed economy makes everyone worse off. Consumers want more choice at cheaper prices, not the opposite, which is what is happening now.

Bright's banter

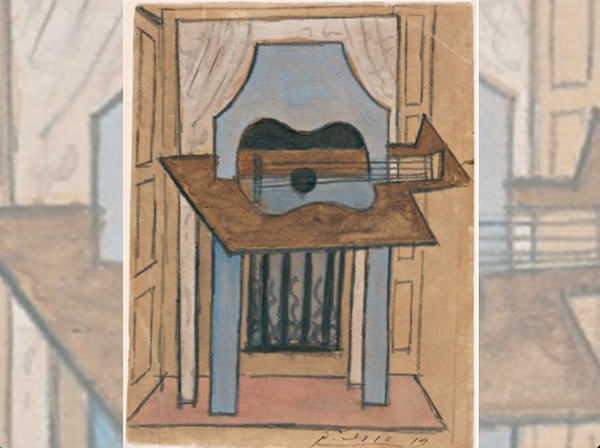

If you needed another reminder that art isn't always the brightest corner of the investment universe, look no further than the latest "Picasso heist".

A EUR600 000 piece by the Spanish master vanished somewhere between Madrid and Granada during a four-hour drive that mysteriously required an overnight stop. Two guards "watched over" the cargo, 56 other artworks arrived safely, yet Picasso's Still Life with Guitar simply evaporated.

That's the art market: high insurance premiums, low liquidity, and the ever-present risk that your "asset" could literally disappear. Art doesn't compound, pay dividends, or sit snugly in a custodian account. Diversification is a fantasy, and no amount of provenance can protect against human error - or good old-fashioned greed.

Art is beautiful, but investors who prefer appreciation over passion and adrenaline, equities remain the saner canvas. Transparent, regulated, and grounded in actual performance rather than packaging mishaps. Picasso may have mastered form, but when it comes to preserving value, markets still hold the brush.

Linkfest, lap it up

Antibiotic resistance is accelerating. Some say antimicrobial resistance is just basic evolution - Getting out of this pickle won't be easy.

Ponte Tower is an icon of the Jozi skyline. It has a rich history and great views of the city - Airbnb a Ponte penthouse.

Signing off

Asian markets are mixed this morning as traders tread cautiously after a strong week for global equities. Domino's Australia shares soared over 17% before being halted, following reports that Bain Capital is weighing a potential buyout of the regional branch of the pizza chain.

In local company news, FirstRand is acquiring a 20% stake in AI-driven fintech Optasia ahead of its R6.5 billion to R8 billion JSE listing, marking a bold bet on tech-enabled lending for underbanked consumers across 38 emerging markets.

US equity futures are unchanged pre-market. The Rand is trading at R17.22 to the US Dollar.

After the bell, all eyes will be on earnings from Visa and Booking Holdings - two bellwethers that should give investors a pulse check on global consumer spending and travel demand. We expect very firm numbers.

It's Tuesday. Give it horns.